What are your TRUE chances of getting rich in America?

OR

How to get rich in America

REFERENCE

"The history of the great events of this world are scarcely more than the history of crime."--Voltaire -- Covert History; accessible 2-24-07

"Behind every great fortune there is a crime."-- Honoré de Balzac -- Mexico’s Plutocracy Thrives on Robber-Baron Concessions By EDUARDO PORTER; August 27, 2007; nytimes.com

"For unto every one that hath shall be given, and he shall have abundance: but from him that hath not shall be taken away even that which he hath." -- Matthew XXV:29, KJV" -- The Matthew Effect in Social Networks; April 15, 2007; paul.kedrosky.com |

To answer this question we first have to define "rich".

In The super-rich, the 'plain' rich, the 'poorest' rich...and everyone else I explain how and why I conclude that a household or family with an annual income at least ten times that of the average-- with no one in the family actually working to make it-- qualifies as rich in America today.

So the basement income to qualify as 'rich' will here be considered to be $400,000 in annual income that'll come in regardless of whether anyone in the family is holding a paying job or not.

As pointed out in The super-rich, the 'plain' rich, the 'poorest' rich... even winning the maximum prizes available in high-profile sweepstakes like the Publisher's Clearinghouse won't get you into the 'rich' category without still more large gobs of luck to go with it. Some winners may find themselves in worse financial shape a few years after winning than they were before! And prestigious awards like the Nobel Prize, Pulitzer, or MacArthur Foundation Award fall even shorter in regards to propelling winners into the 'rich' class.

|

-- Yahoo! News - Woman Who Won the Va. Lottery Is Broke; Strange News - AP; May 03, 2004; citing The Roanoke Times

"These people believe they are millionaires. They buy into the hype, but most of these people will go to their graves without ever becoming a millionaire," -- Winning the lottery with no riches: Unlucky winners who lost the money (Page 1 of 3) By Ellen Goodstein; Bankrate.com; accessible online 4-29-07 "...what has emerged as something of a pattern among lottery winners nationally: Someone with little training in dealing with vast sums of money gets a sudden windfall, only to see it tumble maddeningly into the wind." "This guy's a blue-collar factory worker. The only thing he did that you could even say is wrong is he trusted his financial advisers." -- Lottery winner blames bad advice for his losses From $5.5 million to living on a pension By DERRICK NUNNALLY; April 20, 2007; jsonline.com |

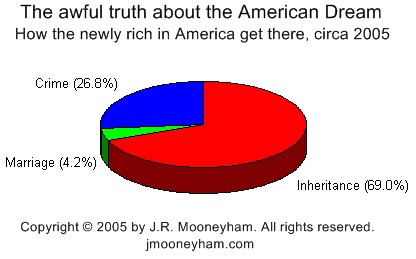

Turns out inheritance of wealth is by far your best bet. Flip side? If you have no such prospects your chances of ever attaining riches dims substantially.

It appears that 69% of everyone qualifying as rich today basically inherited their wealth. So if you have a rich relative who really really likes you (and is considerably older than you), you may have a shot there.

|

-- The Super Rich Are Out of Sight by Michael Parenti; December 27, 2002

"I think that luck plays an enormous role...Society may want to do something about luck."

-- conservative economist Milton Friedman -- The wages of luck Republican icons Milton Friedman and William J. Bennett acknowledge the link between the birth lottery and poverty. Can their conservative brethren learn from them? By Matthew Miller, 9/28/2003; Boston.com "Bill Gates is a smart, determined, and hardworking man, but you need more than that to make as much money as he has. You also need to be very lucky." -- How to Make Wealth; May 2004; paulgraham.com "People don't become rich because they are smart," -- Intelligence not linked to wealth, according to US study; AFP; April 24, 2007; rawstory.com "...of all the factors that we might consider, where we start out in life has the greatest effect on where we end up. In the race to get ahead, the effects of inheritance come first and merit second, not the other way around." -- The Meritocracy Myth by Stephen J. McNamee and Robert K. Miller, Jr. University of North Carolina at Wilmington; ncsociology.org; accessible online on or around 8-25-05; Sociation Today Volume 2, Number 1 Spring 2004 "...studies indicate that inequality in market economies may be very hard to get rid of." -- There's one rule for the rich...; eurekalert.org; 9-Mar-2005; UK CONTACT - Claire Bowles claire.bowles@rbi.co.uk 44-207-611-1210 New Scientist Press Office, London; US CONTACT – Kyre Austin kyre.austin@reedbusiness.com 1-617-558-4939 New Scientist Boston office Of those on the 1997 Forbes 400 list, less than one third (31%) did not possess a wealthy background to begin with, or inherit substantial funds from their family on which to base their own fortune or start a business. -- Born Rich: The Wealth Concentration in America; Liberal Ink; 11-13-03; centuryinstitute.org; accessible online on or about 5-9-05 -- Success in Life Depends Greatly on Where a Child Lives, Study Finds; January 5, 2007; foundationcenter.org "It's a world of connections, that's it. If you're young, have no connections, and you're from a modest family, there's nothing you can do, your whole life. This is a big loss to society, a society in which you can't put your talents to use. This kind of society will keep declining." -- Takafumi Horie -- A Renegade's Tale of His Scorn for Japan's 'Club of Old Men'By NORIMITSU ONISHI; January 6, 2007; nytimes.com |

Marrying rich? Hope you like your wealthy cousin!

Marrying into wealth isn't so different from inheriting it as many people think. For example, it might still be a requirement that you're related by blood to your spouse(!)

|

"The rich have frequently chosen inbreeding as a means to keep estates intact and consolidate power"

-- Go Ahead, Kiss Your Cousin Heck, marry her if you want to By Richard Conniff; DISCOVER Vol. 24 No. 8 (August 2003) |

Don't be too quick to dismiss the notion of marrying into wealth. For that appears to be how 4.2% of the newly rich do it.

Unfortunately for the gold diggers among us, there's only roughly 31 such eligible men per year, and 31 women, throughout the entire country.

So 69% basically inherit their wealth, 4.2% marry into it, and 26.8% make it in other ways.

So what sort of people exist in the 26.8%? It's an eclectic mix representing many different sorts, from top crime lords and corporate executives to superstars among the entrepreneurial, film, and music crowds, and the biggest lottery winners in history. Steve Jobs of Apple Computer was one of the entrepreneurial breakouts of these, long ago.

So is there any way to figure out the percentage of the newly rich getting that way from both outright illegal as well as maybe technically legal but unethical activities? Like both big-time dealers in illicit drugs, weapons, and human trafficking, as well as top corporate executives responsible for stealing the pensions or health benefits from thousands or hundreds of thousands of workers, or bilking investors, or secretly committing acts imperiling worker or customer safety or the environment?

Maybe so. For there are some estimates of money laundering to go on here. And all the money that's successfully laundered ends up making its owners smell like roses so far as the public or law enforcement is concerned in regards to their actions.

Basically big-time crooks must at some point 'launder' their money, or disguise it as legitimately gotten gains, in order to spend or invest it in any practical manner without incurring unwanted scrutiny or other problems from official society.

Today there's probably at least $1.5 trillion per year of money being laundered worldwide.

|

In 1996 (almost ten years ago as of 2005) it was estimated money laundering worldwide could be occurring at a scale of up to $1.5 trillion per year.

-- Basic Facts about Money Laundering; found on or about 9-10-05; www1.oecd.org |

As in general some 21.2% of all (accounted for) economic activity occurs in or about the USA, it seems safe to assume at minimum a similar proportion of global money laundering is taking place there as well. Or at least $318,000,000,000 worth. Annually.

|

In 2004 the estimated USA GDP was $11,750,000,000,000 out of a total $55,500,000,000,000 for the entire world. Or some 21.2%

-- CIA - The World Factbook -- Rank Order - GDP; found on or about 9-10-05; cia.gov |

If the $318,000,000,000 of laundered money is distributed among criminal households in America in a fashion similar to that of legitimate funds, then even among criminal families only the top 1% of them would qualify as rich as defined on this site. And that 1% might possess close to 40% of the total annual income for the group. Or $127,200,000,000.

|

"The top 1 percent own almost 40 percent of the wealth–compared with less than 13 percent 25 years ago."

-- What kind of capitalism? By Juan T. Gatbonton; manilatimes.net; July 6, 2003 |

Overall nationwide of ALL the wealthiest 1% (legal and not), 77.38% make between $400,000 and just under $1 million per year, 22.6% between $1 million and less than $175 million, and 0.02% $175 million or more.

| -- The super-rich, the 'plain' rich, the 'poorest' rich ...and everyone else |

Assuming these proportions hold for crime families too, it appears negligible (zero) crime households of this sort are making anywhere close to $175 million a year.

So it appears all criminally financed wealthy households of this kind in America enjoy incomes above $400,000 a year, but well below $175 million a year.

As there's just some 1,464 newly rich US households each year, and we've already accounted for 1072 of them deriving from inheritance or marriage, that leaves only 392 in which any new criminally rich may emerge.

If the criminally rich gain in numbers at roughly the same rate as the officially sanctioned rich (which successfully laundered funds would enable), then their total number may grow at about 7% per year.

|

"The number of ultra-high-net-worth individuals is expected to grow 7% a year during the next few years..."

-- US Led a Resurgence Last Year Among Millionaires World-Wide By Robert Frank; Wall Street Journal; June 15, 2004 |

So we've got an estimate here of a total amount of criminally made money laundered into the system, plus percentages regarding what fraction of that money likely goes to what portion of the wealthy criminal population in America. And an idea for how much that wealthy population may grow annually.

We also have a ceiling for the actual number of newly rich criminals there could be: 392.

That is, in a year around 2005 where it just so happened that every newly wealthy household was generated either via inheritance, marriage, or crime-- and no other method whatsoever-- 392 would be approximately the maximum number possible for such criminals.

So since we're hurting here for more precise data, why not play with the numbers available to us, and see if that gives us an idea how far off or wrong the 392 number might actually be?

For instance, if 392 represented the total number of newly rich US crooks in 2005-- and approximately 7% the number of pre-existing rich crook population in the country-- then the total number of rich criminal households in America would have to be around 5,600. Out of maybe 132 million total households.

That would put the wealthy criminal element in America at roughly 0.00424% of the total population.

Hmmm. That sounds entirely plausible! Which is surprising to me personally, as I expected the opposite result. I.e., I did the calculation simply to get a sense of how preposterous it might be for all 392 newly rich in America each year without inheritance or marriage sources to usually stem from crime alone.

So newly rich criminal households could easily account for every single new wealthy household appearing in a given year in America without benefit of inheritance or marriage.

That would leave the number stemming from actual legal breakthrough entrepreneurial successes like Steve Jobs of Apple Computer, superstar billing in music or films like Britney Spears or Cameron Diaz, or the biggest lottery wins in history as basically just statistical noise. So that in general very near 100% of the newly wealthy in America are getting there by way of inheritance, marriage, or outright crime.

Keep in mind the above figures dealt only with criminals like the higher ups of drug, prostitution, and slavery rings; crooks who must launder their money to get it into the conventional economic system.

But there's a whole other bunch of wrong doers who might never have to launder their money in such a way, as their profits are generated from 'inside' the system to start with, rather than outside: the white collar bunch who exploit secrecy, weaknesses in government regulations and law enforcement, the lag of policy updates behind technological advances, and plain old political corruption to wrongfully endanger or steal from their employees, investors, customers, or tax payers, leaving the rest of us facing the fallout for years or decades to come in environmental degradation, higher deficits and taxes, fewer public services, deteriorating infrastructure, looted pensions and benefits, higher prices, fewer good paying jobs, and slower innovation due to less honest competition. For those additional figures we'd have to plumb the estimates of securities fraud and other such elements occurring per year in America. And yes, I'll try to get to that too as I get the opportunity.

|

"There are plenty of other ways to get money, including chance, speculation, marriage, inheritance, theft, extortion, fraud, monopoly, graft, lobbying, counterfeiting, and prospecting. Most of the greatest fortunes have probably involved several of these."

-- How to Make Wealth; May 2004; paulgraham.com

"Cold-blooded, remorseless egomaniacs in the boardroom are a hidden threat to your job, your savings and your investments.""...the damage they inflict on society is out of all proportion to their numbers, not least because they gravitate to high-profile professions that offer the promise of control over others, such as law, politics, business management ... and journalism." "...natural- born predators." -- Snakes in suits and how to spot them By Giles Whittell; November 11, 2002; timesonline.co.uk "When you see what has happened with Enron and WorldCom and all these other big corporations, and you ask how the hell could this guy get in that position, well, there are answers...When the structure's not there, when charisma is extremely important and style wins over substance..." -- Dr Robert Hare -- Snakes in suits and how to spot them By Giles Whittell; November 11, 2002; timesonline.co.uk "...such hypocrisy...is something like a job requirement for CEOs." -- The CEO Candidate How Mitt Romney's corporate success explains his campaign—and his flip-flops. By Daniel Gross; Feb. 26, 2007; slate.com "The wording is so bland and buried so deep within a 324-page budget document that almost no one would notice that a multibillion-dollar scam is going on....And that is exactly the idea...." "...They create this...for the benefit of a small group of the politically well connected..." "...a select group of investors and companies will walk away with billions of dollars in tax subsidies..." "...the obscure jargon of all special-interest tax breaks--almost impossible to decipher, so bewildering is its language..." "...Many lawmakers, if not most, don't even know it's there..." "..."the provision originated as an amendment from Sen. [Rick] Santorum [a Pennsylvania Republican]...." -- A magic way to make billions By DONALD L. BARLETT, JAMES B. STEELE; February 27, 2006; cnn.com

According to the science in the report below, it appears any body capable of wide-ranging effects upon an economy may either purposely increase economic opportunity and security moderately for the majority of the population, or heap extreme helpings of same onto just a few. It would seem both governments and large corporate and criminal organizations would all enjoy such power. "...wealth, in different forms, can stick to some but not to others." "By tweaking the conditions, they could make preferential attachment -- a power-law distribution of the number of connections -- stronger or weaker." -- Why the Rich Get Richer; April 2, 2007; news.ucdavis.edu; Media contact(s): Raissa D'Souza, Center for Computational Science and Engineering, (530) 754-9089, raissa@cse.ucdavis.edu, and Andy Fell, UC Davis News Service, (530) 752-4533, ahfell@ucdavis.edu -- Top 20 Largest Cases of Companies Caught For Committing Fraud Against the Government | Government Dirt; accessible online 4-18-07; governmentdirt.com "...the most common methods of finding out about financial fraud were still...calls to hotlines or tips from whistle-blower employees." "...fraud was detected by chance in more than a third of the cases, while internal audit detected the fraud 26 percent of the time." "Of those who committed the fraud in North America, 60 percent were employees of the defrauded company. Almost one-quarter of the perpetrators were senior managers--the very people required to sign off on financial statements." -- Most corporate fraud found by luck: study By Emily Chasan; Nov 29, 2005 -- Profit-driven corporations can make management blind to ethics, study says; NEWS - Cutthroat Corporate Culture Causes Moral Blindness FROM: Nancy Gardner (206) 543-2580; nancylou@u.washington.edu; January 9, 2006 -- Report Gov't Secrecy Grows, Costs More - Yahoo! News By MICHAEL J. SNIFFEN, Associated Press; 9-3-05; news.yahoo.com ["http://www.openthegovernment.org/otg/SRC2005_embargoed.pdf" is the URL of the report.] -- Banished Whistle-Blowers - New York Times; September 1, 2005; nytimes.com "...50 percent of all economic crime detection came from internal or external investigations and audits. Another 36 percent of economic crime detection came from whistleblowers." -- Economic Crime Detected Mainly by Whistleblowers and Audits, PwC Survey Finds By: SmartPros Editorial Staff; July 9, 2003; accounting.smartpros.com -- The Crime: Slow Job Growth. A Suspect: Enron. by DANIEL GROSS; September 11, 2005; nytimes.com |

But just skimming some estimates for these seem to further support the overall criminal path to riches, and in the proportion speculated of here.

For example, one old estimate of corporate crime costs stands at 2.6 trillion dollars.

|

"...corporate crime cost the U.S. economy about 2.6 trillion dollars (in 1994 dollars)...These mind-boggling numbers actually leave out a number of other serious and costly crimes, such as money laundering, redlining, capital flight, insurance fraud, illegal attempts to destroy unions, and securities fraud."

-- Capital Crimes: The Political Economy of Crime in America by George Winslow; Monthly Review November 2000; monthlyreview.org |

Yikes!

Although the reference above provides a breakdown of the total into items including tax fraud, a much larger number than that for total tax cheating is given in the 2004 article below: $311 billion per year. This larger figure may account for both the lost taxes from white collar corporate crime and the more easily defined crime lords described earlier.

And as the 2006 article shows, the number just keeps rising.

|

-- Stroke the rich

IRS has become a subsidy system for super-wealthy Americans IRS winks at rich deadbeats by David Cay Johnston; April 11, 2004; sfgate.com

"...roughly $345 billion, or more than 16% of all taxes owed, initially went unpaid in 2001....this year's gap could be $400 billion or more."

-- U.S. sees red over back taxes By Richard Wolf, USA TODAY, 3-1-06 |

The US government actually seems to encourage internal corruption as well as corporate crime-- so long as it involves sufficiently large sums.

For the richer a crook gets from his crimes, the less likely the government will investigate his ill-gotten gains with a tax audit or other means.

"Clearly our priorities are perverse...Our government punishes the good guys and lets, in some cases, the really bad guys help run the show and set the agendas."-- Danielle Brian, director of Project On Government Oversight in Washington -- Waste and fraud inevitable in rebuilding, experts say By Seth Borenstein, Knight Ridder Newspapers; Sep 23, 2005; news.yahoo.com "The political influence of bankers tops all other sectors, I learned as a young reporter. Regardless of party or ideology, politicians seek their friendship. So the United States has created a truly bizarre banking code that legalizes--and keeps secret--vast flows of ill-gotten gains. For what purpose? Terrorist financing, yes, but that business is dwarfed by the drug trade profits, insider looting of corporations, offshore tax evasion, securities fraud, plain-vanilla fraud, and other uses." -- Dirty Money by William Greider, citing The Nation of June 24, 2006 "The results suggest that wrongdoing by public officials at all levels of government is deeply rooted and widespread." -- F.B.I.'s Focus on Public Corruption Includes 2,000 Investigations By DAVID JOHNSTON; May 11, 2006 "...systemic corruption within the highest levels of government." -- FBI Assistant Director Chris Swecker, speaking about the Abramoff case. -- In Congress, 'we simply have too much power' analysis by Jim Drinkard, USA TODAY; Jan 10, 2006 -- The Case of Jack Abramoff and Friends: Federal Government Facilitates Political Corruption By Elaine D. Willman, MPA, 1/6/2006 "Corruption isn't a natural disaster: it is the cold, calculated theft of opportunity from the men, women and children who are least able to protect themselves," -- David Nussbaum, Chief Executive of Transparency International -- Corruption rampant in 70 countries; 18 Oct 2005; business.iafrica.com -- U.S. Companies Lag in Responsibility, Accountability - Study by Abid Aslam; Sep 24, 2005; news.yahoo.com -- Republican Party is very accommodating to rich tax avoiders By ROBYN E. BLUMNER; St. Petersburg Times; December 1, 2002 -- A GOP reward for fleeing taxes By Molly Ivins; Nov. 28, 2002; Star Telegram "...tax enforcement has fallen steadily under President Bush, with fewer audits, fewer penalties, fewer prosecutions and virtually no effort to prosecute corporate tax crimes." -- Corporate Risk of a Tax Audit Is Still Shrinking, I.R.S. Data Show By DAVID CAY JOHNSTON; April 12, 2004; nytimes.com "While letting rich tax cheats run wild, Congress did finance a crackdown on the poor. The working poor, most of whom make less than $16,000, are eight times more likely to be audited than millionaire investors in partnerships." "While wage earners have every dollar of income reported to the government, the super rich control what the IRS knows about their incomes. But the rich are rarely audited anymore. Congress also gives them many perfectly legal devices to defer reporting income for years or decades. That means that the real incomes of the super rich are much larger than the IRS data show and their tax burden is even lighter." -- Stroke the rich IRS has become a subsidy system for super-wealthy Americans IRS winks at rich deadbeats by David Cay Johnston; April 11, 2004; sfgate.com "When it comes to tax cheats, the government has been vocal about catching the little guys but hasn't focused on the big-time frauds, like Swift Boat financier Sam Wyly, who happens to be a top-tier Republican contributor." -- How Tax Cheats Are Using Your Money to Fund Republicans By Lucy Komisar, AlterNet. Posted April 17, 2007; alternet.org "The figures at the top may be misleading, though, because the I.R.S. is much more accurate in capturing wage income than income from businesses and investments." "In addition, a sharp decline in audits combined with the marketing of devices to help people understate their true income make figures for the highest nonwage incomes less reliable. Generally these strategies, which range from the little known but legal to criminal tax evasion, do not work for wage earners." -- Income Down From 1999, Tax Data Show By DAVID CAY JOHNSTON September 28, 2005 "The Bush administration has illegally stopped making public detailed tax enforcement data, which has been used to show which kinds of taxpayers get the most and toughest audits..." "...since Nov. 1, 2004, the Internal Revenue Service has violated a 1976 court order requiring the release of the data." -- IRS Said to Improperly Restrict Access By MICHAEL J. SNIFFEN, Associated Press; Jan 8, 2006 |

Heck, besides doing its best to stamp out whistleblowing and independent audits and investigations, the government also bends over backwards in other ways to empower insider crime. Like literally hiding some possibly incriminating information under the rubric of "national security" or "executive privilege" or by utilizing other forms of censorship.

|

-- Another blow to openness

Companies can use new Homeland Security Act to shield their misdeeds By THOMAS W. Newton; ocregister.com [the file saved to disk is not date-stamped, but appears to have been published on or around December 1, 2002]

-- Are We Protecting Secrets or Removing Safeguards? (washingtonpost.com) By Gary S. Guzy; November 24, 2002; Page B01 -- Official Secrets News: Is the Bush administration using terrorism fears to shield government -- and business -- from public view? By Daniel Franklin; January/February 2003 Issue; motherjones.com -- Silence About Secrecy (washingtonpost.com) By Mary McGrory; September 12, 2002; Page A23 -- Members hit White House over secrecy =TheHill.com= By Alexander Bolton; thehill.com; AUGUST 7 , 2002 -- 'Homeland Secrecy'; sfgate.com; July 30, 2002 -- Factory Farms Fancy Secrecy By Bill Berkowitz; July 17, 2002.; alternet.org -- Too many secrets by DAN K. THOMASSON; June 28, 2002; Scripps Howard News Service/nandotimes.com -- Code of Quiet The Secret War on Whistle-Blowers by Geoffrey Gray; June 19 - 25, 2002; villagevoice.com |

Of course the best and easiest way to avoid the availability of incriminating information is to not collect it in the first place. Or else avoid any credible analysis of existing information which might lead to you or your cronies getting into hot water.

"precise financial losses resulting from White Collar Crime (WCC) for consumers, government, and business are unknown since no systematic data collection exists."-- quote from the 2001-2006 strategic plan of the US Justice Department -- Corporate Crime and Abuse: Tracking the Problem; Center for Corporate Policy; corporatepolicy.org; accessible online on or around 10-5-05 |

One way the government does things like this is by basically allowing corporate lobbyists to write the rules of regulation under which big businesses (and even government agencies!) are run.

But despite them writing their own rules, these guys often can't even abide by those! Apparently due to them feeling they have everything so securely under their thumb that even their own custom-made rules are meaningless.

|

"The researchers went on to theorize that getting power causes people to focus so keenly on the potential rewards, like money, sex, public acclaim...preferably all at once — that they become oblivious to the people around them."

"The corollary is that as the rich and powerful increasingly focus on potential rewards, powerless types notice the likely costs and become more inhibited." "In social psychology terms, disinhibited Fast Forward types need ordinary cautious mortals to remind them that the traffic lights do in fact occasionally turn yellow or even, sometimes, red." -- The Rich Are More Oblivious Than You and Me - New York Times By RICHARD CONNIFF; April 4, 2007; nytimes.com -- Top 20 Largest Cases of Companies Caught For Committing Fraud Against the Government | Government Dirt; accessible online 4-18-07; governmentdirt.com |

Another way government aids wealthy crooks and insiders is by making it easy for them to hide portions of their income or assets through use of various loopholes which serve to protect them from taxes or accurate accounting by outsiders. So often the actual net worth and income of the rich or the corporate are even larger than the awesome amounts indicated by the statistics released to the public.

"Clearly our priorities are perverse...Our government punishes the good guys and lets, in some cases, the really bad guys help run the show and set the agendas."-- Danielle Brian, director of Project On Government Oversight in Washington -- Waste and fraud inevitable in rebuilding, experts say By Seth Borenstein, Knight Ridder Newspapers; Sep 23, 2005; news.yahoo.com -- U.S. Companies Lag in Responsibility, Accountability - Study by Abid Aslam; Sep 24, 2005; news.yahoo.com -- Republican Party is very accommodating to rich tax avoiders By ROBYN E. BLUMNER; St. Petersburg Times; December 1, 2002 -- A GOP reward for fleeing taxes By Molly Ivins; Nov. 28, 2002; Star Telegram -- A culture of bribery in Congress; Dec 2, 2005; The Christian Science Monitor "Our culture's very cutthroat, very focused on money, our economy creates big rewards for the winners on top and insecurity for the people who don't get to the top," "Ordinary people feel like the rules don't really make any sense. They look at big shots in our society who often cheat and end up winning or cheat and get away with a slap on the wrist...People are very cynical these days that any rules are worth following." "The fish sort of rots from the head down, the trickle-down corruption in America...People see the cheating by the CEO's and the celebrities and they think, why not cut corners myself!" -- Our cheating culture By SAINT BRYAN; April 12, 2007; king5.com "...tax enforcement has fallen steadily under President Bush, with fewer audits, fewer penalties, fewer prosecutions and virtually no effort to prosecute corporate tax crimes." -- Corporate Risk of a Tax Audit Is Still Shrinking, I.R.S. Data Show By DAVID CAY JOHNSTON; April 12, 2004; nytimes.com "While letting rich tax cheats run wild, Congress did finance a crackdown on the poor. The working poor, most of whom make less than $16,000, are eight times more likely to be audited than millionaire investors in partnerships." "While wage earners have every dollar of income reported to the government, the super rich control what the IRS knows about their incomes. But the rich are rarely audited anymore. Congress also gives them many perfectly legal devices to defer reporting income for years or decades. That means that the real incomes of the super rich are much larger than the IRS data show and their tax burden is even lighter." -- Stroke the rich IRS has become a subsidy system for super-wealthy Americans IRS winks at rich deadbeats by David Cay Johnston; April 11, 2004; sfgate.com |

I'm curious if this policy has anything to do with the fact many of our top governmental officials appear to be substantially better off than the rest of us (financially speaking). And election campaign laws have practically assured no poor person can run for office without the blessing of the rich themselves.

|

-- President discloses at least $8.8 million in assets in 2002 Vice President reports worth of at least $19 million By Deb Riechmann; Associated Press;

May 17, 2003; The Daily Camera

-- Welcome Back Congress: Wealth Watch Congressional Megabuck Members:Top Five In Roll Call Fifty Are Worth $50 Million or More citing 1996 Roll Call Inc.; accessible online on or around 9-20-05 -- 50 RICHEST IN CONGRESS ; scholar.lib.vt.edu citing THE VIRGINIAN-PILOT; February 15, 1995 "Without counting outside sources of income, the earnings of members of Congress rank within the top 5 percent of the nation" -- House to Vote on Pay Raise for Lawmakers By JIM ABRAMS, Associated Press/Yahoo! News; Sep 04, 2003 -- Senate remains a rich man's -- and woman's -- club, finances show BY ALAN FRAM; Associated Press/Miami Herald; Jun. 14, 2003 -- Dividend Tax Cut Will Benefit Many in House, Financial Reports Show (washingtonpost.com) By Juliet Eilperin; June 17, 2003; Page A03 -- Reports show senators' holdings in oil, drug industries By Dan Morgan; THE WASHINGTON POST/The Austin American-Statesman; June 14, 2003 "The Republican Party enjoys nearly unchallenged control of the federal government. The congressional ethics committees...have been moribund. The cost of running for office and the amount of money being spent on influencing the government have grown sharply." -- In Congress, 'we simply have too much power' analysis by Jim Drinkard, USA TODAY; Jan 10, 2006 "House lawmakers Tuesday accepted a $3,300 pay raise that will increase their salaries to $168,500." -- The Wages of Sin; June 20, 2006; billmon.org |

Now if you steal a TV set or car (or rob a bank) all sorts of law enforcement folks will be after you.

But just juggle the books in government or corporate business to shift millions or billions from employee pensions or health benefits (or small investors) to the pockets of you and co-conspirators, and often no one will care at all. Yeah, the employees will get a horrible surprise at retirement (or the next time they get injured or ill)-- as will the investors in their own aspirations-- but you and your cohorts will likely get away scot-free. That's how it's done in America.

"As the old adage says, the little thieves get hung and the big thieves get richer and richer. When it comes to larceny, it pays to be ambitious."-- What the Republican Revolution has wrought It's the I Got Mine You Get Your Own party, marching under a Christian banner. By Garrison Keillor; Oct. 24, 2007; salon.com -- Health plans dwindle in U.S. Number of firms offering insurance drops as costs rise by Victoria Colliver; September 15, 2005; sfgate.com "Twenty percent of large, private-sector U.S. employers will probably terminate health insurance benefits within the next three years for workers when they retire..." -- More Firms to End Health Benefits for Retirees (washingtonpost.com) By Bill Brubaker; washingtonpost.com; January 15, 2004; Page E04 "If these trends continue...every year the share of Americans who have employer-sponsored health coverage will fall." -- Drew Altman, president, chief executive of the Kaiser Family Foundation. -- Higher Costs, Less Care By Ceci Connolly, Washington Post; Sep 28, 2004; story.news.yahoo.com -- Whoops! There Goes Another Pension Plan - New York Times; nytimes.com; 2005/09/18 "Widespread cuts in health insurance and pensions for the rank-and- file are driven by a special law that lets top executives defer paying taxes for years, in a way that adds 35 percent to the cost of their bloated pay." -- Stroke the rich IRS has become a subsidy system for super-wealthy Americans IRS winks at rich deadbeats by David Cay Johnston; April 11, 2004; sfgate.com "In 1973, the ratio of CEO pay to worker pay was 43 to 1. By 1992, it was 145 to 1. By 1997, it was 326 to 1. By 2000, it hit a sky-high 531 to 1." -- A steeper ladder for the have-nots By Derrick Z. Jackson; May 18, 2005 "...the chief executives of the nation's 500 largest companies got a collective 38 percent pay raise last year, an average of $15.2 million each." -- Steve Jobs Tops List Of Highest Paid CEOs by Christopher Rizo; May 4, 2007; allheadlinenews.com -- Money for nothing - Warren Buffet on why most CEO compensation models are broken; accessible online on or around 8-28-07; cambrianhouse.com -- Bad CEOs who walked away rich by Liz Moyer; Forbes.com; 11/10/2007 -- US sage attacks executive greed by Abigail Rayner; May 05, 2003; timesonline.co.uk

-- Arizona Republican Senator John McCain -- Corporate 'Tax Reform:' Rich Get Richer While Taxpayers Get Screwed By DOUG THOMPSON; Oct 12, 2004; capitolhillblue.com |

But maybe you'd like some more information regarding the massive corporate and/or government crime going on in America these days. Well, for those of you presently visiting the version of this page which includes references, a sampling follows below [CLICK HERE to get the references page if necessary]:

|

"No one can dispute that in the insurance industry there was massive fraud..."

-- New York Attorney General Eliot Spitzer -- Spitzer calls critics 'apologists for the powerful' - Yahoo! News by By Ed Leefeldt, 9-15-05; news.yahoo.com -- The Graft Goes On By Molly Ivins; September 14, 2005; alternet.org -- Firms with Bush ties snag Katrina deals; Reuters; 9-10-05; news.yahoo.com "what apparently started as a stopgap measure may have morphed into a serious moral hazard situation, with market manipulation an endemic feature of the U.S. stock market." "...frequent surreptitious intervention, conducted through intermediaries, the government's favored financial houses in New York, gives those intermediaries enormous advantages over ordinary investors." "It is most unfair that the immensely powerful have been further ensconced in their perched positions and thus effectively insulated from the competitive market forces ostensibly present in our society." "By not informing the public, successive U.S. administrations have employed a dangerous policy response that is subject to the worst possible abuse." -- Government Intervention in Stock Market is Detailed by New Report, GATA Says; September 6, 2005; biz.yahoo.com; ["http://www.sprott.com/pdf/pressrelease/TheVisibleHand.pdf" and "http://www.gata.org/SprottReportTheVisibleHand.pdf" are URLs for the original report.] "Fifty-one percent of 280 fund managers...said...that U.S. earnings are the worst in the world when it comes to predictability, volatility and transparency." -- Pierre Belec, Reuters; 2002 -- Not Buying the U.S. Earnings Story By Pierre Belec; Jun 22, 2002;Yahoo! /Business - Reuters -- Profits: They Aren't As Good As They Look By Pallavi Gogoi and Robert Berner; Businessweek; FEBRUARY 10, 2003 -- The "Enronization" of America By Thane Peterson; Businessweek; JUNE 10, 2003 -- I WANT THE PRESIDENT TO CERTIFY THE GOVT'S BOOKS By JOHN CRUDELE

"According to some estimates we cannot track $2.3 trillion in transactions"-- US Secretary of Defense Donald Rumsfeld "We know it's gone. But we don't know what they spent it on...they have to cover it up...that's where the corruption comes in. They have to cover up the fact that they can't do the job." -- Jim Minnery, Defense Finance and Accounting Service "[the defense budget] numbers are pie in the sky. The books are cooked routinely year after year" -- Department of Defense Analyst Franklin C. Spinney "With good financial oversight we could find $48 billion in loose change in [the Pentagon building]" -- Retired Vice Admiral Jack Shanahan -- The War On Waste (possibly by Vince Gonzales); CBSNews.com; Jan. 29, 2002

"the federal government is keeping its books much like Enron did, and all of us will end up paying for it"-- Sheila Weinberg, the Institute for Truth in Accounting -- Federal reports blasted BY KEN GOZE; West Proviso [IL] Herald, 1/1/2003; Digital Chicago Inc.; http://www.pioneerlocal.com/cgi-bin/ppo-story/localnews/current/wp/01-01-03-27530.html [this article was cached for a time at http://www.unknownnews.net/cache34.html, where it was found on or about 1-1-03] "...factors like the "depressing prospective of a minimum-wage existence" and the poor example set by government and corporations are making crime look mighty profitable." -- Life Of Crime Becoming Viable Career Move For Youths - 2004-03-04; Wireless Flash Weird News; ncbuy.com "Americans overall do not prosper; corporations do. But we allow it because we are frightened into acceptance every time." -- How Dare You Threaten Us With Peace by Brian Bogart; January 11, 2006 |

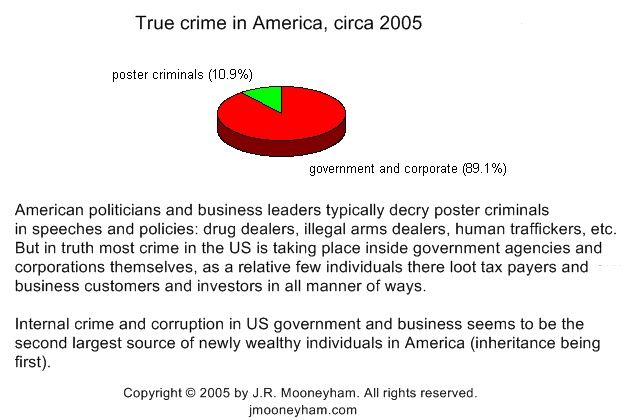

Notice anything here? Namely, the amount of crime going on in government and corporate agencies in America dwarfs that in the so-called 'outlaw' community our leaders typically rail against.

So in America, various corporate executives, politicians, bureaucrats, and generals appear to be responsible for at least EIGHT TIMES the criminal acts of folks like drug dealers, human traffickers, and black market arms dealers-- at least in financial terms.

Yikes!

Folks, if there's almost TEN TIMES the crime going on in our government and corporate circles than among the 'outlaws' we officially send our police and FBI agents after every day-- and we punish shop-lifters and the homeless much more frequently and about a zillion times harsher than the well dressed crooks stealing tens of millions or even billions of dollars from the rest of us-- isn't there something wrong with our system?

|

In 2003 America, stealing $200 worth of video tapes can get you a life sentence in prison while a $1200 theft of golf clubs can get you 25 years.

-- Cruel, but Usual; March 7, 2003; The Foundation for National Progress; related stories include $11 theft gets career criminal 25 years to life and 50 years' jail for video thefts upheld -- Fla. Homeless Man Faces 10 Years For Spitting On Deputy -- Man gets life in prison for spitting on police; CNN Steven R. Frazier got five years in prison and an order to pay $500 a month for 30,000 years for trying to make a living off selling unauthorized satellite TV signal unscrambling boxes. And no, that "30,000 years" is NOT a typo. -- $180 million at $500 a month . . . By Vickie Chachere; The Associated Press; June 28, 2003; orlandosentinel.com Note that one of the constitutional principles undergirding America is supposed to be a ban on cruel and unusual punishment. Perhaps the closest thing to predictability in American criminal sentencing today is that the rich or powerful who steal millions or billions of dollars, or harm thousands or millions by their actions or inactions, usually get far lighter punishment (if any) than poor whites or blacks or other disadvantaged citizens involved in crimes which are trivial by comparison.

"Criminal prosecutions are highly unusual for corporate criminals, and convictions carrying jail time are even more rare."-- Big crimes? Maybe. Big punishment? Not likely; Yahoo! Op/Ed - USA TODAY; Gannett Co. Inc.; Feb 5, 2002 -- Crime And (Very Little) Punishment by Arianna Huffington; Arianna Online; July 15, 2002 -- WorldCom, Enron execs elude charges By David E. Rovella; BLOOMBERG NEWS; Aug. 20, 2003; bayarea.com -- Punishment falls short of crime against investors By Dan Gillmor; Dec. 21, 2002; siliconvalley.com Gross inconsistency in punishments for businesses which knowingly abused their customers often results in negligible penalties for relatively large-scale crimes. -- Penalizing Wall Street: Pick a Fine, Any Fine By Heather Timmons and Mike McNamee; Businessweek; DECEMBER 23, 2002 -- Banking's Bigwigs May Be Beyond the Law's Reach By Mike McNamee, Nanette Byrnes, and Emily Thornton; Businessweek; MAY 19, 2003

"Swipe a CD from a record store and you'll get arrested. But when Congress authorizes the entertainment industry to steal from you -- well, that's the American way." -- Supreme Court Endorses Copyright Theft by Dan Gillmor; January 15, 2003; weblog.siliconvalley.com "...in its 2001 report the FBI estimated that the nation's total loss from robbery, burglary, larceny-theft and motor vehicle theft in 2001 was $17.2 billion -- less than a third of what Enron alone cost investors, pensioners and employees that year." -- Corporate Crime and Abuse: Tracking the Problem; accessible online on or around 9-28-05; corporatepolicy.org -- Insiders Collected $1 Billion Before Refco Collapse By GRETCHEN MORGENSON and JENNY ANDERSON October 20, 2005 "All classes commit crime. However, the poor experience higher rates of arrest, criminal charges, convictions, long prison sentences and denial of parole. This winnowing process ensures that most rich criminals never see the inside of a prison, while overflowing them with the poor." -- Myth: The criminal justice system is not biased against the poor.; accessible online 4-3-07; huppi.com |

So 69% basically inherit their wealth, 4.2% marry into it, and virtually all the rest make it via criminal acts.

Yeah, sure there's the occasional superstar like Apple's Steve Jobs or Britney Spears who defy the mainstream statistics. Plus a mega-lottery winner now and then. But those are so few as to rate as noise or rounding off errors in the numbers.

|

"Despite a $1 yearly salary, Apple chief executive Steve Jobs still managed to top Forbes' list of highest paid CEOs for 2006, raking in more than $646 million through stock-based compensation -- more than twice that of the next highest paid boss."

-- Apple's Steve Jobs tops list of highest paid CEOs By AppleInsider Staff; May 4, 2007; appleinsider.com |

Plus there's a small multitude of popular entertainers and athletes whose incomes spike into rich territory briefly only to sputter out later, leaving those folks in the bottom 99% of income again at some point, if they didn't save for a rainy day.

|

"History is filled with examples of wealthy people who have squandered their fortunes through poor money management."

-- Lifestyles of the Rich and Stupid 1st April 2007 (by J.D.) ; getrichslowly.org/blog/ -- Bankrupt celebrities; accessible online 4-18-07; nndb.com |

Yikes! Surely that's not so! You might say. Not in America! That inheritance, marriage, and crime represent the only realistic paths to wealth!

Alas, this appears to be the case according to research.

"We are living the American Dream in reverse...""...The hourly wages of average workers are 11 percent lower than they were back in 1973 (adjusted for inflation), despite rising worker productivity. CEO pay, by contrast, has skyrocketed -- up a median 30 percent in 2004 alone...[and]...Americans work over 200 hours more a year on average than workers in other rich industrialized countries....The share of national income going to wages and salaries is the lowest since 1929."-- American Road Leads Off a Cliff by Holly Sklar, citing the Providence Journal, December 29, 2005 ["http://www.projo.com"]

-- America's rags-to-riches dream an illusion: study By Alister Bull; Apr 26, 2006 |

Don't believe me? Then let's examine the numbers further... What's the number of folks ACTUALLY getting rich each and every year in America? How many are reaching the point where they're likely to have $400,000 a year or more coming in from now on, despite being effectively 100% retired?

Well, in order to earn $400,000 a year purely from something like interest, how big would your principal have to be?

Based on the interest currently generated by my own savings it appears that number would be roughly around $35 million.

So someone a millionaire 35 times over could swing it.

With income taxes roughly amounting to 50% for gigantic lottery wins in America, that means someone who won around $70 million all for themselves (no need to split it with a pool of ticket buyers) could get rich-- IF they immediately stuck the money into interest bearing accounts and waited a full year to spend a penny. And never ever withdrew more than a single year's worth of interest annually.

In 2003 the USA boasted 2.3 million millionaires. A 14% increase in a year, according to CNN. Or perhaps some 322,000 new millionaires for the year.

| -- 1 in 125 Americans are millionaires - Jun. 15, 2004; money.cnn.com |

Unfortunately you'd need to be a 35x millionaire at minimum to earn the interest required to be rich.

So can we determine how many 35x millionaires are created in the US each year on average?

Hmmm. That number is apparently very hard to come by. But let's try making an educated guess.

Turns out somebody documented the fact there were around 70,000 individuals worldwide in 2003 with $30 million or more in financial assets each.

| -- World's richest worth $29 trillion in 2003; June 15, 2004; Reuters |

Yeah, I know. I said 35x millionaires were needed to reach the level of wealth defined here. And these figures at hand will only help determine numbers relating to 30x millionaires. So we are fudging a bit. But still our calculations should get us into the general ballpark for the purposes of this page. And if 30x millionaires could find a way to get a better interest rate than I currently do, then they might achieve the magnitude of wealth we're looking for after all. That's not entirely implausible. After all, folks with a much bigger principal than I possess should have more options interest-wise.

For reasons of comparison with other estimates here I'm going to assume that each of these individuals basically accounts for the lion's share of the income for their immediate family or household.

So we've got 70,000 households worldwide in 2003 possessing $30 million or more in financial assets each.

Around 2001 Merrill Lynch coined the term "ultra-high-net worth individuals" or "UHNWIs" to describe these folks. Another source said they expected this group would grow by roughly 7% each year around 2005 and thereabouts.

|

"The ranks of deca-millionaires--those with more than $10 million in net assets--has grown from just 48,100 households in 1983 to 274,000 in 1998--a fivefold increase in 15 years."

-- Tuesday, citing Fairy Tale Falls Short for Rich By ASHLEY DUNN; March 14, 2000; Los Angeles Times -- Google Search: newly minted multi-millionaires "Mr. Smith noted the wealth of ultra-high-net worth individuals (UHNWIs) have investable assets of more than $30 million) increased 6% to $8.37 trillion. The number of UHNWIs rose 3% to an estimated 57,000 people at the end of last year." The report seems to be saying this was so for the year 2000. -- portland imc - 2003.08.30 - The Super Rich Are Out of Sight citing "World Wealth Report - 2001" at http://www.ml.com/about/press_release/pdf/05142001_worldwealthreport2001.pdf from Merrill Lynch. "Most striking: the study found that in the U.S. and Canada, the number of ultra-rich -- those with investment assets of more than $30 million -- has reached 30,000..." "The number of ultra-high-net-worth individuals is expected to grow 7% a year during the next few years..." -- US Led a Resurgence Last Year Among Millionaires World-Wide By Robert Frank; Wall Street Journal; June 15, 2004 |

So we've got roughly 70,000 of these "ultra-high-net worth individuals" in 2003, with some analysts expecting this number to grow by around 7% annually.

That would give us approximately 4,900 new 30x millionaires or better a year worldwide, circa 2005.

So how many of these are new US millionaires? Maybe 1,464 if the 30x and better millionaires number is proportional to the total US share of global millionaires.

|

In 2003 there were 2.3 million millionaires in the US, compared to 7.7 million worldwide. So near 29.9% of all millionaires worldwide lived in the US.

-- 1 in 125 Americans are millionaires - Jun. 15, 2004; money.cnn.com |

So there's possibly 1,464 new 30x and better US millionaires per year.

|

On 4-3-05 there were about 295,798,362 people in the US.

-- U.S. and World Population Clocks - POPClocks; census.gov |

1,464 new truly rich folks a year out of 295,798,362 in America results in a 0.000004949 chance of any US citizen attaining this status for the first time next year.

Or about one chance out of 202,061.

That means if somehow you could make the whole world maintain its current state indefinitely-- with the only difference being you yourself were immortal-- then you'd need only wait another 202,061 years to definitely become rich yourself! Hooray!

But wait! The above figures include those who basically inherit their wealth. So what's the number who get rich without such an advantage?

Apparently around 454 per year. Of course this number may still include many who get rich by marrying into wealthy families. Could we possibly estimate that number? Maybe.

Let's see: It appears over two million marriages a year take place in America. So over four million (at least some 1.56% of Americans) marry each year.

|

"More than two-million marriages are performed each year in the United States."

-- THIS IS AMERICA #1068 - Weddings By Jerilyn Watson; 6/11/ 01; manythings.org "More than 2.3 million couples will tie the knot in the United States this year..." -- Love in bloom: Summer brides embrace traditions and trends; pressroom.americangreetings.com; Contact: Amanda Todorovich / 216.252.7300, ext. 2912; accessible online on or about 8-24-05 On 4-3-05 there were about 295,798,362 people in the US. -- U.S. and World Population Clocks - POPClocks; census.gov |

If we assume that wealthy Americans possess the same tendency towards marriage as all other Americans, then some 62 marriages in the US each year may involve at least one person of sufficient wealth to establish an all new rich household.

|

"More than two-million marriages are performed each year in the United States."

-- THIS IS AMERICA #1068 - Weddings By Jerilyn Watson; 6/11/ 01; manythings.org "More than 2.3 million couples will tie the knot in the United States this year..." -- Love in bloom: Summer brides embrace traditions and trends; pressroom.americangreetings.com; Contact: Amanda Todorovich / 216.252.7300, ext. 2912; accessible online on or about 8-24-05 There appears to be around 999,800 households or family units in the USA around the dawn of the 21st century who qualify as independently wealthy. BUT-- the vast majority of these likely cannot spin off an entirely new household or family group which itself will qualify as rich too. Even if the wealth available is split right down the middle for the task. So we need to further prune the numbers. How many wealthy households could actually generate a whole new rich household via marriage if wished? At minimum twice the annual income required to get into the wealthy ranks in the first place would have to be available. Or $800,000 a year. This takes us to about 226,000 US households. But of course few households would likely be willing to hand over as much as 50% of their net assets to help form a new wealthy household. So just how rich would a family have to be in order to shrug off the assets required to form an all new wealthy household via marriage? Or at least $400,000 worth of annual unemployed income? Well, the 200 households making at minimum $175 million a year could do that with no concern whatsoever-- as $400,000 for them per year amounts to a rounding error. So those 200 families can certainly spin off such new family units via marriage with no problem at all. Indeed, they might spend $400,000 or more on the marriage ceremony alone. If 1.56% of those super-rich 200 families produce a marrying member per year, that would amount to three supremely eligible men and women annually. But what of the rich households making between $800,000 and $175 million per year? Where's the typical cut off point? That is, at what level of wealth does it become sufficiently bearable for an existing household to basically hand over $400,000 a year in income in order to begat a new one of 'poor' rich status? I suppose that depends on just how extravagant a lifestyle the original household is accustomed to. Plus how easily they might be able to ratchet up their subsequent income to make up for the permanent diversion of funds. Perhaps most households would tend to sustain such a loss if $400,000 represented something less than 20% of their yearly income. After all, there will be the side benefit of the kids moving out! So let's settle on the figure of 20% here. That would put the threshold of income for willingly spinning off a new $400,000 per year income family unit at around $2 million annually for the original household. So how many households earn $2 million or more annually in the US? Well, there's roughly 225,800 making between $1 million and $175 million per year. But how to figure how many make at least $4 million a year? Asset net worth. If a net worth of $30 million is necessary to collect $400,000 minimum a year in interest, then a net worth of $150 million may be required to get $2 million annually. Yikes! OK, I admit here I don't have the financial savvy claimed by Wall Street brokers and big bankers. So there may be all sorts of ways to make more than $2 million a year off a nest egg of $150 million. All I'm doing here is basing my calculations on what my own bank gives me in interest on my own investments, and scaling it up. So in the dumbest, easiest, most straightforward, and maybe worst way to generate income off a nest egg, it appears at least $150 million would be necessary to earn $2 million a year. If anything like this number holds for a substantial number of the truly wealthy, then that drastically reduces the likely number of all new wealthy households which might be spun off annually from existing family units. -- The super-rich, the 'plain' rich, the 'poorest' rich ...and everyone else For there appears to be only some 3959 US households in possession of net worths of $150 million or more (rounded off from 3958.63). If these households produce marrying folks at the same rate as Americans in general, then some 62 (rounded off from 61.76) eligible men and women from these families get married each year. I derived this number from an interpolation where F(x)=(((x-xb)/(xa-xb))ya)-(((x-xa)/(xa-xb))yb). (Yes, I'm awfully rusty in my mathematics, so anyone more proficient is invited to correct my calculations.) Forbes reported in 2004 some 400 Americans of a net worth of $750 million or more. -- The Forbes 400 By David Armstrong and Peter Newcomb, Matthew Miller, Jackie Brown, Danielle DiPenti and Adam Kemezis. Additional reporting by Kiri Blakeley, Erika Brown, Brendan Coffey, Kerry Dolan, Jonathan Fahey, Stephane Fitch, Lea Goldman, Christopher Helman, Patrick Keenan-Devlin, Daniel Kruger, Seth Lubove, Victoria Murphy, Dorothy Pomerantz, SarahThorpe and Nathan Vardi; 10.11.04 The Rich Register 2005 lists 4,700 Americans as having a net worth of more than $25 million apiece. I'm assuming here that we can take the above number as representing some 4700 separate wealthy households. That is, that the majority of individuals listed do not live in the same home with one another. -- The Rich Register 2005; hoovers.com So are my estimates of the interest generated on such sums even in the ballpark when compared to real world situations? Well, getting hold of such information is notoriously difficult. But here goes. The legal battle over the estate of the late founder of Herbalife International offers us one peek. The estate was reportedly worth close to $400 million in mid-2000. Since then some $17-20 million in various legal and other fees have been subtracted from it. But the trustees expect the estate to be worth well over $500 million by around 2027-- when it all goes to its legal heir. Whatever the total amount currently existing, it's yielding something like $3 million a year. Information relating to a different family member involved in all this says they themselves have a net worth of over $10 million, which is yielding them over $600,000 per year in income. The article seems to say that this second person also gets $120,000 a year in child support, plus $100,000 a year for other expenses. It's unclear if these other amounts are included in the $600,000 annual income mentioned before. But my impression is that they are not. $600,000 generated per year from $10 million works out to maybe a 6% interest rate. $3 million generated per year from $400 million indicates a 0.75% interest rate. I guess the awful rate has something to do with ongoing legal fees taking a bite out of the action. So anyway in these two cases of real world big money we get an interest rate range between 0.75% and 6%. A range in which my previous assumptions seem still to fit. -- A boy and his $400 million By Robert W. Welkos; 9-13-05; news.yahoo.com |

As the truly wealthy represent such a miniscule percentage of the population, we can probably safely assume that the number of annual marriages where both partners are wealthy is so small as to be statistically insignificant.

So for our purposes here virtually all (100%) American marriages including a person of such wealth will also include a much poorer mate.

This leaves us with around 392 Americans each year getting rich without basically inheriting it or marrying into wealth (454 minus 62).

Unless of course already wealthy households are willing to part with more than 20% of their wealth to help the new family unit enjoy wealthy status. In that case the number of newly rich achieving their wealth without benefit of inheritance or marriage could be lower.

But let's be optimistic!

This leaves us with maybe as many as 392 openings for folks being reborn rich per year in America without benefit of inheritance or marriage.

392 per year amounts to 26.8% (rounded off from 26.7759) of the total 1,464.

So how do the 26.8% of the newly rich without benefit of inheritance or marriage do it?

Unfortunately, it appears almost all of them do it by breaking the law. As described earlier on this page.

But once in a blue moon someone seems to make it in legal fashion.

So let's examine the channels of wealth-acquisition available to average, law-abiding citizens. Albeit microscopic opportunities compared to the monumental avenues of inheritance, marriage, and crime, most of these courses are none-the-less often touted by various popular authors and powerful political factions, despite them almost never working out for the vast majority of those who try them.

Note that the fact these channels never work for more than 1% of those who try them, at most (based on official historical records of wealth) and likely truly work for only something like 0.0004% of the population (according to the information listed in this page: a rate no better than pure random luck, as in a lottery), has done nothing to diminish the credibility of those authors and political groups among the populace, as there's virtually zero media scrutiny of their claims. Before, during, or after the fact. So those authors and political operatives reliably rake in the profits and other benefits of their claims year after year, decade after decade, with no one of prominence challenging the truth of their statements.

Why? Partly because the truth is so hard to come by-- and even if acquired, difficult to analyze. And after that, awfully complex to present to the man in the street.

Haven't you noticed that aspect of this page? The bewildering, overpowering nature of the details and complexity necessary to get at the truth?

Another reason those folks aren't challenged on their claims is Americans-- like all folks everywhere-- want to believe their country is the best place in the world; special. Better than other places, in all the ways that matter most.

And maybe more than anything else, Americans want to believe in the American dream.

But the truth shows that to be overwhelmingly a lie.

Who wants to accept that? Certainly not me! Nor most other Americans, I'm sure.

But anyone who truly craves freedom and opportunity must seek out the truth of their existence. To do otherwise is to court failure at the least-- and calamity at worst.

So shall we examine those avenues to wealth-building so often hyped by charlatans among us?

#1: Getting rich in the stock market: For most small investors the stock market is basically just a branch office of Las Vegas

So it's just another lottery, where pure luck will usually be the major determining factor of success or failure (unless you're already wealthy). See further below for more on pure luck ventures.

|

"...the idea that you can do this yourself, that's out the window."

-- David F. Swensen, chief investment officer of the Yale endowment, author of book "Unconventional Success: A Fundamental Approach to Personal Investment" speaking about the research necessary for successful investing. -- Pro Tells Why the Little Guy Just Can't Win; August 13, 2005; nytimes.com "For the vast majority of investors—including professionals—stock-picking efforts waste both money and time." -- Why the world's greatest stock picker stopped picking stocks, and why you should, too. By Henry Blodget; Jan. 22, 2007; slate.com -- 'Zero intelligence' trading closely mimics stock market by Katharine Davis; 01 February 2005; newscientist.com "If I showed a string of capuchin monkey data to an economist, he couldn't, with any statistical test, tell the difference between a capuchin monkey and your average American stock market investor." -- Monkeys and Humans Are Both Irrational by Maggie Wittlin; May 16, 2006 "As for making good decisions in our lives, when we do it is mostly random." -- ROGER SCHANK, Psychologist and Computer Scientist -- ROGER SCHANK; THE WORLD QUESTION CENTER 2005; available online on or around 4-2-05; edge.org "...over a 200-year period, the stock market had an average annual real rate of return of 6.8 percent." -- This Very, Very Old House By RUSSELL SHORTO; March 5, 2006 "The job of the private-equity investor is...to exploit the idiocy of the ordinary investor..." -- Michael Lewis, Bloomberg News, 12 December 2006" -- Hedge Funds, Junk Bonds, Ponzi Schemes by Eugene Plawiuk; January 06, 2007; plawiuk.blogspot.com -- Chasing the holy grail: the algorithmic arms race The finance industry's secret weapon By Bob McDowall; 7th January 2007; regdeveloper.co.uk "...economist Gary Shilling's..."How to Make Big Money: 11 Time-Tested Strategies."...help America's 8 million millionaires (and billionaires) to get richer, but they're not much help to the other 292 million Americans." "...There are actually two distinct kinds of risk. Risk is fundamentally different for the rich, it almost doesn't exist! They can use these strategies to their advantage, to manage risk and build equities. But the other 292 million are stuck with the leftovers, not equities but systemic liabilities, such as higher taxes, drug costs, excessive fund expenses, limited opportunities, outsourcing, etc." "This gap is not just an income gap as Shilling points out, it's a risk gap. The rich get the equities, the rest get the liabilities." -- How to Make Really Big Money by Paul B. Farrell; March 22, 2007; finance.yahoo.com "At any given time in the capital markets there are at least two sets of rules -- one for the rich and well-connected, another for the middle class..." "With the shrewdest and most sophisticated investors armed with essentially unlimited capital, any company that is available to the public is almost by definition an inferior asset, i.e., an asset that the private-equity people have no interest in. We may not have arrived at the point where the publicly traded shares in a company are a sure sign that those shares are a poor investment. But that's the obvious, ultimate destination. Which raises the question: Why do the proles continue to invest in publicly traded companies? And the obvious answer is: They have no choice." "The ordinary investor is now and forever cast in the role of the peasant at the king's banquet." -- Stocks -- Coach Class of Capitalism: Michael Lewis (Update1) By Michael Lewis; December 11, 2006; bloomberg.com "The average dollar invested in the stock market in...[the last 80]...years has earned only about 8.6 percent a year." "...the typical investor in Nasdaq earned only 4.3 percent...[from 1973 through 2002]....This is true not just in the United States — the same thing occurred in 18 of 19 international markets that Mr. Dichev examined." "Anything that you think is news is old hat to the professionals. Trying to outguess the market is a sucker’s game." -- Sometimes the Stock Does Better Than the Investor That Buys the Stock - New York Times By HAL R. VARIAN; May 3, 2007 |

However, if you are a psychopath you have a considerably better chance than 99% of other Americans at attaining wealth in the stock market and elsewhere.

|

"...the best stock market investors might plausibly be called "functional psychopaths."

...many company chiefs and top lawyers may also show they share the same trait." -- Psychopaths could be best financial traders?; Reuters; 9-19-05; news.yahoo.com "Professor Hare estimates that 1% of the general population in North America are psychopaths." "They could be perfectly qualified for top posts in the military, politics or in huge multi-national companies..." -- Is your boss a 'corporate psycho'?; 13 January, 2004; news.bbc.co.uk "...up to 50 per cent of business managers could have psychopathic or similar tendencies...manipulative characteristics are often rewarded in the business world." -- 50pc of managers could be psychopaths: research 12/01/2007. ABC News Online; BBC; abc.net.au "One of the most important comments on deceit, I think, was made by Adam Smith. He pointed out that a major goal of business is to deceive and oppress the public. And one of the striking features of the modern period is the institutionalization of that process, so that we now have huge industries deceiving the public—and they're very conscious about it, the public relations industry. Interestingly, this developed in the freest countries—in Britain and the US—roughly around time of WWI, when it was recognized that enough freedom had been won that people could no longer be controlled by force. So modes of deception and manipulation had to be developed in order to keep them under control." -- Noam Chomsky -- Noam Chomsky + Robert Trivers The anti-war activist and MIT linguist meets the Rutgers evolutionary biologist in the Seed Salon to discuss deceit. by Edit Staff • Posted September 6, 2006; seedmagazine.com "...employees in the US are bullied up to 50% more often than workers in Scandinavia. However, just 9% of employees were aware that the negative acts they experienced constituted bullying, suggesting that bullying behaviour is ingrained in the culture of the US workplace." "...the negative effects are widespread: employees who witness others being bullied suffer secondary harm, reporting high levels of stress, and low levels of work satisfaction." "The study concludes that US organizational and cultural structures frequently enable, trigger, and reward bullying. U.S. companies stress market processes, individualism, and the importance of managers over workers, which discourages collaborative efforts and enables powerful organizational members to bully others without recrimination." -- Workplace bullying 50 percent higher in the US than Scandinavia; 29-May-2007; Contact: Verity Warne verity.warne@oxon.blackwellpublishing.com Blackwell Publishing Ltd. |

#2: Inventing, marketing, or working your way to riches: For most getting rich will have little or nothing to do with the merit of their ideas or how hard they work

Got a great idea you think could make you rich? There's very little chance of that. Sure, your idea might be great, but it's much more likely to be effectively stolen from you in one manner or another rather than bringing you great rewards. Or else you'll simply never be able to gather the resources needed to launch it.

This is why stories about the very very few folks who did succeed in such efforts (like Steve Jobs of Apple Computer) are so well known to practically everyone around the world: they are the ultra rare exceptions.

And all this is despite the fact that the very best company workers might be 50 times more valuable to their employer, than the worst. And yet the very worst in the company may well often get the top positions and top pay(!)

|

"The reason the media raves about and idolizes those who've built wealth through creativity is because they're so rare."

-- The easiest way to get rich; paulstips.com; 16 October 2006 "...in some jobs, the top one per cent outperforms the bottom one per cent by a ratio of about 50 to 1." -- Selection tool could revolutionize hiring, online dating; 6-Mar-2006; Contact: Gregory Harris gharris@ucalgary.ca 403-220-3506 University of Calgary

"Cold-blooded, remorseless egomaniacs in the boardroom are a hidden threat to your job, your savings and your investments.""...the damage they inflict on society is out of all proportion to their numbers, not least because they gravitate to high-profile professions that offer the promise of control over others, such as law, politics, business management ... and journalism." "...natural- born predators." -- Snakes in suits and how to spot them By Giles Whittell; November 11, 2002; timesonline.co.uk "When you see what has happened with Enron and WorldCom and all these other big corporations, and you ask how the hell could this guy get in that position, well, there are answers...When the structure's not there, when charisma is extremely important and style wins over substance..." -- Dr Robert Hare -- Snakes in suits and how to spot them By Giles Whittell; November 11, 2002; timesonline.co.uk "Professor Hare estimates that 1% of the general population in North America are psychopaths." "They could be perfectly qualified for top posts in the military, politics or in huge multi-national companies..." -- Is your boss a 'corporate psycho'?; 13 January, 2004; news.bbc.co.uk

-- Warren Adler, author of 27 novels, including "The War of the Roses," on which the film of the same name was based. -- Steal This Book. Or at Least Download It Free. By CLAUDIA H. DEUTSCH; August 21, 2005; nytimes.com

-- If At First You Don't Succeed How my father tried to reconcile his big ideas with a small-minded world. By Hillary Johnson; Inc. Magazine, July 2003 "...just plain bad luck can suppress the effects of merit." -- The Meritocracy Myth by Stephen J. McNamee and Robert K. Miller, Jr. University of North Carolina at Wilmington; ncsociology.org; accessible online on or around 8-25-05; Sociation Today Volume 2, Number 1 Spring 2004 "A 1979 Carnegie study ("Small Futures: Children, Inequality, and the Limits of Liberal Reform", Richard de Lone principal investigator) found that a child's future to be largely determined by social status, not brains." -- An Overview of Social Inequality; trinity.edu; accessible online on or about 8-25-05 "...IQ scores only account for about 10% of the variance in income differences among individuals..." "Educational attainment clearly depends on family economic standing and is not simply a major independent cause of it. The quality of schools and the quality of educational opportunity vary according to where one lives, and where one lives depend on familial economic resources and race. Most public schools, for instance, are supported by local property taxes. The tax base is higher in wealthy communities and proportionally lower in poorer areas." -- The Meritocracy Myth by Stephen J. McNamee and Robert K. Miller, Jr. University of North Carolina at Wilmington; ncsociology.org; accessible online on or around 8-25-05; Sociation Today Volume 2, Number 1 Spring 2004 "The language of business is not the language of the soul or the language of humanity. It's a language of indifference; it's a language of separation, of secrecy, of hierarchy." (Quoted, Bakan, The Corporation, Constable, 2004, pp.55-56)" "Secrecy is a key aspect of corporate media control. It is a secrecy protected by walls of silence." "The reality is also that all corporate media consistently, over decades, suppress critiques of their own practices, and there is next to nothing the public can do about it." "Secrecy and silence are jealously guarded by media gatekeepers and are rooted in a form of absolute power..." "Media decisions are made behind closed doors, in corporate meetings completely inaccessible to the public....No one even knows that silence on a particular book or topic has been manufactured by corporate media with identical interests right across the spectrum. It is a kind of negative thought control - we don't know, and we don't know that we don't know." -- Silence, Secrecy and Book Reviews by David Edwards; March 07, 2006 It's especially risky, tough (and expensive!) to be a low income inventor/innovator in America today, as $10,000 to $30,000 can be required just to go through the patent process itself (mostly in patent lawyer fees). -- Nando InfoTech, on or about 5-6-97 In 1998 the average cost of a complete patent infringement lawsuit in the USA, with appeal, was roughly one and a half million dollars for each side of the dispute. -- Would You Buy a Patent License From This Man? By Ian Mount; April 2001; eCompany Now -- When It Comes to Innovation, Geography Is Destiny - New York Times By G. PASCAL ZACHARY; February 11, 2007 -- Entrepreneurs sacrifice health for success -- Slashdot | Inventor of Optical Storage Gets Little Reward Posted by michael; Dec 28, '04; citing Scientist's invention was let go for a song By Brier Dudley; November 29, 2004; seattletimes.nwsource.com

"At one point, Mr. Pavel said, he owed his lawyer hundreds of thousands of dollars and was being followed by private detectives and countersued by Sony. "They had frozen all my assets, I couldn't use checks or credit cards," and the outlook for him was grim." -- An Unlikely Trendsetter Made Earphones a Way of Life By LARRY ROHTER; December 17, 2005

"I have known other inventors in similar predicaments and most of them become that story, which is the most tragic, sad and melancholic thing that can happen...Somebody becomes a lawsuit, he loses all interest in other things and deals only with the lawsuit."

-- Andreas Pavel -- An Unlikely Trendsetter Made Earphones a Way of Life By LARRY ROHTER; December 17, 2005 "GEOFF GOODFELLOW is a Silicon Valley entrepreneur who came up with an idea that resulted in a $612.5 million payday. But he will never see a penny of it." -- In Silicon Valley, a Man Without a Patent By JOHN MARKOFF; April 16, 2006; nytimes.com "Finally, five years after his brainstorm became the law, Szilagyi, who earned about $80,000 annually at the time, was given a check for $25,000. By this point, his idea had generated roughly $14 billion." -- Filling in the Tax Gap By STEPHEN J. DUBNER and STEVEN D. LEVITT April 2, 2006; nytimes.com -- Why you can't earn $1,000,000 selling your software ["http://www.pastukhov.com/researches/why_you_can_t_earn_1_000_000_as_a_software_developer.php"] apparently by Max Pastukhov; found on or about 5-17-06 "An extension to the protections on intellectual property, the harshening of the bankruptcy process, the removal of social safety net protections, and rampant healthcare inflation all work to slow entrepreneurial activity." -- The Anti-Entrepreneurial State by John Robb; March 09, 2005; jrobb.mindplex.org |

#3: And yes, the above relates to your chances of getting rich via your own small business, too.