The super-rich, the 'plain' rich, the 'poorest' rich

...and everyone else

Life at the top of the human food chain...and elsewhere

Everything you might want to know about wealth and the richest among usREFERENCE

This page is dedicated to my sister Jeanie and her husband Scot

BACK to The super rich...contents

Perhaps it would be beneficial at this point to define "rich", as intended for use in this and directly related documents. For the definition of rich or wealthy has been much muddied by political propaganda and even some questionable fudging of figures by certain government agencies in recent history.

|

"The super rich...go uncounted in most income distribution reports"

Until 1994, the U.S. Census Bureau simply didn't gather the same info on folks making over $300,000 a year as they did everyone else. Beginning in 1994, they raised the bar to $1 million-- so now everyone making over $1 million a year are often ignored and left out of many economic reports and analyses. -- The Super Rich Are Out of Sight by Michael Parenti; December 27, 2002; CommonDreams.org |

Here, when I speak of the rich or wealthy I am not referring to the riches of intellect or joy or other intangibles which even a penniless monk in Tibet might be able to partake of in some measure, but of cash money or assets easily converted to same, and the power that often accompanies it.

I'm also not referring to the paltry amounts of money most of us deal with in our lives, but much, much higher quantities of the stuff.

Many Americans don't have a clue about what comprises real wealth in the USA

There's often news reports in the US media and elsewhere about how ill-informed and ill-educated average Americans are in regards to matters like world geography and others. But our financial savvy may be the worst of all. Want an example? Many of us have no idea how much money it takes to be truly rich. So we don't daydream about getting rich: we actually long merely to reach the status of upper middle-class(!), mistakenly believing that would put us firmly into the realm of the wealthy.

Many Americans long merely to reach the status of upper middle-class, mistakenly believing that would place them in the realm of the wealthy

|

"Most Americans say a tidy $200,000 a year would do just fine — and a plurality would settle for $100,000"

-- Poll: How Much Would It Take to Be Rich? By Daniel Merkle; ABC News; date stamp appears to be October 13, 2000. -- United States a nation of financial illiterates By Humberto Cruz; The Register-Guard, Eugene, Oregon, USA; May 5, 2003 "a lack of education that teens and college students receive about personal finances is a major factor behind the debt levels that are piling up among this age group" -- Rising Debt Among Young Worries Experts By Catherine Valenti; ABC News; June 20, 2003 -- Global goofs U.S. youth can't find Iraq - Nov. 22, 2002; CNN |

Most of us likely have never met a truly rich person face-to-face.

|

"95 percent of households take in less than $150,000 a year. Ninety-nine percent of households make less than $374,000"

-- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 |

We might know of local folks we consider rich, who live in big houses, always drive expensive new cars, and maybe even own a few hundred largely undeveloped acres and/or farmland around their homes or elsewhere, as well as perhaps own and work (at least part-time) at a major business in town. Heck, we might even have been friends with their sons or daughters, and envied a bit the extra material goods they often sported relative to our own. But those local bigwigs are rarely rich-- just 'well off', and enjoying a few more perks in daily life than the rest of us. Those perks might include their high school kids being able to drive new cars immediately upon getting their licenses, while other kids must toil for a couple years to buy a used one. The perks often include nicer and trendier clothes. More music paraphenalia. Cosmetic dental work. Nose jobs. Etc. But still, just perks. Things of which at least a selected few would be available to the rest of us too if we wanted them badly enough.

But the true rich would consider those 'well off' folks of our neighborhoods quite impoverished. And perhaps even be astonished and repelled by some details of those 'well off' folks' lives. As for what many of them would think of us still poorer folks' daily routines, well, I suspect they don't. Think of them, I mean. Have much idea at all that such lives even exist.

Oh sure, some of the actual rich are 'enlightened' either through education or happenstance, and thereby learn something of what our existence is like. And a few were even just like us at some point in their lives, but managed to escape that economic tier via one method or another. Of all these, I wouldn't be surprised if many strived mightily to forget what they learned of such circumstances. I know there's many aspects I'd like to forget, if money someday became of no concern to me! Ha, ha.

Besides comprising just around 1% of all folks in the USA, thereby reducing the chances of us poorer folks meeting them to around one out of a hundred, other factors tend to reduce this chance still more. For example, the truly rich may own their own planes, or charter flights, and so fly regular commercial airliners much less frequently than the poorer classes. And when they do take regular commercial flights, they can more easily purchase the option of first class accomodations than others.

The rich also tend to cluster together in upscale neighborhoods, rather than the places the rest of us live. So it's pretty unlikely the lower income 99% will find themselves living in the same vicinities as the top 1% (unless we comprise the live-in help for such folks: butlers, maids, chefs, nannies, chauffeurs; for we obviously can't afford to buy our own homes in such neighborhoods)-- thereby reducing the chance for random meetings still more.

|

"Over the last 20 years...the nation's housing market has been cleaved in two, and the break has helped create two very different economies in one country"

Residential areas which were already the most expensive in their respective regions became even more so, sometimes as much as tripling in price, even after discounting for inflation. The difference in prices is even wider when the most expensive regions are compared to the least expensive-- by as much as six times. -- Around U.S., a House Is a Home but Not a Bonanza By DAVID LEONHARDT; August 6, 2003; The New York Times "More than one in seven of the households were in just 13 of the nation's 3,140 counties..." -- New Rise in Number of Millionaire Families By DAVID CAY JOHNSTON; March 28, 2006 |

Before I go on, I want to say here that I mightily appreciate that small number of the truly rich who go the extra mile to speak up for and help the rest of us in our daily struggles.

|

-- Some of America's Rich Urge No Repeal of Estate Tax; February 14, 2001; Yahoo!/Reuters

-- Well-heeled stand behind estate tax; February 14, 2001; The Associated Press/Nando Media/Nando Times; http://www.nandotimes.com -- This is no April Fool's joke: Rich protest they aren't taxed enough By LEO RENNERT; 3/31/1998; McClatchy Newspapers -- Please tax us, say (some) of America's richest by Duncan Campbell; February 12, 2003; The Guardian "The battle over the 'death tax' pits some of the nation's wealthiest people against . . . some of the nation's wealthiest people. But the stakes are high for the rest of us, too" -- Sharing the Wealth? By Bob Thompson and Michele Capots; Washington Post; April 13, 2003; Page W08 |

As this world increasingly turns exclusively on money, it may be you folks are one of the very few things holding back the creeping darkness for all of us [please see Ragnarok: The war for our destiny for more].

And now back to our discussion.

So how might we define the truly rich? Well, let's try to frame it in a way us non-rich folks can relate to. For instance, having sufficient money so that it's unnecessary to perform gainful employment in order to live well, would seem a requirement. You know, so you could truly pick and choose what you did for a living, regardless of what it did or didn't pay-- if you worked at anything at all?

|

"they could live lavishly without ever having to work a day in their lives"

-- Film subjects take exception to 'Born Rich' By Frank Houston - COX NEWS SERVICE/Alameda Times-Star; June 29, 2003 "I don't need Bush's tax cut...I have never worked a (bleeping) day in my life" -- U.S. Rep. Patrick J. Kennedy (D-R.I.) -- 'I have never worked a (bleepin) day in my life': Kennedy comment draws fire by Andrew Miga; June 28, 2003; the Boston Herald and Herald Interactive Advertising Systems, Inc. |

So part of being rich would be having a purely voluntary choice as to whether you worked or not-- and what jobs you took, if you made that decision.

But recall being truly wealthy means much more than not having to work to live. Quite a few ordinary people might get by much of their lives (50% to 70% of the span) without employment in the business or government workplace, if only they're willing to live on the very least a person can survive on (think homeless), or be financially supported by others in some fashion, either for no more reason than being a blood relative or close friend, or in return for some sort of recompense that they personally don't consider to be work (i.e., being a spouse, homemaker, lover, traveling partner, etc.).

So the lifestyle or living standards, financial security, and scope of choices available to a person also helps define their wealth status.

To explore the scope of available living standards, let's begin with those which may be familiar to the vast majority of US citizens.

The average American household may bring in a total of $40,000 a year.

|

In a study that was published in The Journal of Socio-Economics, May 2003, "the typical family earned $40,000".

-- Study Explains Money Problems in Marriages By Lee Dye; ABCNEWS.com; found on or about 6-5-03 [AUTHOR'S NOTE: This particular regular column on the ABC News site appears to use the same URL all the time, for posting different articles by Lee Dye. Thus, to find the particular column referenced here, you may have to search archives of some kind on the site-- possibly fee-based. Sorry! END NOTE.] "The average American worker earns only about $40,000 per year" -- Jobs, jobs, jobs: Bush’s blueprint By PAUL KRUGMAN; April 23, 2003; TODAY newspaper and ABS-CBN Interactive "The median income was about $43,000 last year. Half of American households received less than that amount, and half received more." "...the federal poverty level for a family of four in 2002 – about $18,000..." -- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 So according to the references above, the average household income of around $40,000 in the US is only something over twice that of folks officially considered to be living in poverty. |

Many such families likely live from paycheck to paycheck, rarely enjoying a substantial quantity of savings as a buffer against adversity. But if they're lucky enough not to be stricken by overwhelming medical bills, or smart enough to avoid going overboard on credit cards, they may get by fairly comfortably (if also pretty stressed out) in a modest single home of their own, with a couple of used cars, cable TV, internet access, and a couple kids or so. They might even manage to eventually provide some financial help to one or more of their kids with college and a second-hand car of their own as well, when the time comes.

Of course, the constant threat of sudden and disasterous medical bills, unemployment, and/or pay cuts for the family breadwinner(s), and other calamities haunts such a family pretty much their entire lives.

"For the majority of Americans, the question is not if they will experience poverty, but when"-- Most Americans Experience Poverty Sometime In Adult Life, Study Finds; 7 APRIL 1999; Contact: Gerry Everding; gerry_everding@aismail.wustl.edu; 314-935-6375; Washington University in St. Louis

"...American families live just one illness or accident away from complete financial collapse""It was very unlikely 30 years ago that an ordinary family could run up a half-million dollar medical bill, yet today that can happen in a matter of weeks in a major medical centre" -- US Study: Medical Bills Main Culprit In Bankruptcies by Araminta Wordsworth; www.commondreams.org; October 09, 2002; originally published by the National Post in Canada, April 27, 2000 "The typical American household now carries $8,500 in credit card debt" -- A deluge of credit S.F. man tallies credit card offers -- 217 solicitations by David Lazarus; March 7, 2003; San Francisco Chronicle "The average American now has eight credit cards and the average household's debt is $16,500, according to the Federal Reserve" "In the second quarter of 2003, says the American Mortgage Bankers Association, more than 400,000 homeowners lost their houses to foreclosure -- a record" -- No Way to Plan, Thanks to Uncle Sam By Ric Edelman; The Washington Post; July 6, 2003; Page B01 "Nearly a quarter of Americans would be late on mortgages, rent or other bills if a single paycheck were delayed" -- Homelessness grows as more live check-to-check By Stephanie Armour, USA TODAY; 8/12/2003 |

If you're like me, you know quite a few folks in approximately this same shape, some a bit better, some a bit worse. And you yourself may be among them.

Since these folks must work on a consistent basis or lose everything, they definitely don't meet our requirements here for being truly wealthy, by a long shot.

But what about the lifestyle requirements? Just how comfortable and secure would someone have to be in order to qualify as truly rich?

How about we frame comfort and security levels in terms most all of us can understand, by using the typical $40,000 annual household before tax income as a base reference?

Now, how much would income have to rise to get into indisputably 'rich' territory?

I propose we try an increase of ten times the average household before tax income, to achieve a minimal level for 'rich' or 'wealthy'.

If the average household earns a total of $40,000 before taxes, then a household enjoying an income ten times greater than that would have a total income of $400,000 a year before taxes.

If the $400,000 a year household can make that money without any member holding a job, then mightn't these folks qualify as truly rich?

Think about it. They should have more free time than the average American by at least eight or nine hours a day (including the job commute), since work for them is purely voluntary. And they receive at least $400,000 a year in before tax income, whether their 'job' pays anything or not (note they could be a full-time unpaid volunteer at something without hurting their income).

The 'poorest' rich as defined here could enjoy at minimum ten times the material goods and services of the average American family-- even if those rich never held a job themselves

This much annual income means these folks could basically maintain ten times the material possessions of the average working family, only with no jobs required. If the working family manages to have one house and a couple cars, these not necessarily working richer folks could have ten houses and twenty cars of similar quality. Or five houses and ten cars of substantially better quality (each costing twice as much as the poorer folks' comparable asset).

Let's assume here these folks go with the superior houses and cars. And that the wealthy households we're discussing typically include just a couple of adults (folks officially recognized as adults under the laws of local jurisdictions).

Though some of these not necessarily employed households do actually maintain such a high number of private domociles and automobiles (as five and ten, respectively), that's not really the most effective use of their funds, since at most they could only inhabit two homes and use two autos at a time-- and so the other three houses and eight cars would just have to sit around empty, gathering dust and requiring the added expenses of maintenance, insurance, security, etc. So I'd guess most such rich folks would stop at just two or three pretty nice houses, and three or four high quality cars, for this category of purchases.

All other things being equal, this could leave them with leftover yearly income amounting to about the same as at minimum four of the $40,000 a year employed households combined, or $160,000 a year in extra before tax income, after all the daily living needs and desires they might share with poorer folk were bought and paid for-- such as food, water, shelter, energy, transportation, basic entertainment and telecommunications gear (TV, internet, phones, etc). Or $160,000 a year they could 'blow' or 'burn' without giving up anything at all, including their three extra nice homes and four luxury autos.

Any year in which they couldn't figure out a way to spend this extra $160,000 (or $13,000 plus a month; about what you could buy outright a brand new low end pickup truck for in 2001), it'd pile up in the bank or investments, and almost immediately push them significantly beyond their original income level, to ever higher ones. Yes, these folks would have to be diligent indeed in their spending, or else they'd soon get considerably richer.

Here's another way to look at the minimum $400,000 a year before tax income bunch: This would work out to a bit more than one and a half times the prize money that a winner in a Publisher's Clearinghouse Sweepstakes that expired around 6-30-03 would get ($5000 per week for life, or $260,000 a year).

So, I guess we can all agree that a before tax income of $400,000, especially without working for it, would pretty well qualify as rich.

Keep in mind that at this level of income, unless you were an imaginative and prolifigate shopper (and perhaps pretty generous too), or loved throwing money away on gambling or high risk investments, you just about couldn't help getting still richer as time went along.

I don't know where the precise point in wealth is that you tend to automatically get richer rather than poorer over time, almost no matter what you do, but $400,000 a year is likely beyond that point circa 2003, for any folks who act semi-responsibly with their money and lives.

So how many folks in the US qualify as truly rich by this standard?

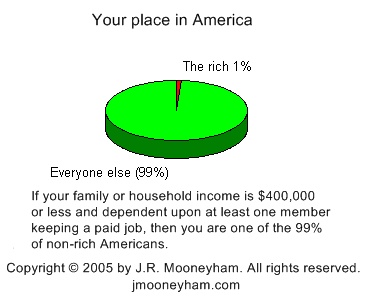

Roughly just one percent of all households.

|

"Ninety-nine percent of households make less than $374,000"

-- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003

The top 1% of American households had a net worth of at least $3 million each in 1998. -- Facts about Wealth apparently by the Archdiocese of St. Paul and Minneapolis; accessible online on or around 8-25-05; osjspm.org |

So if we set the bottom rung for the truly wealthy at $400,000 of before tax income a year, for not necessarily employed folks, where does that leave the top rung?

If I told you, you might not believe me. But here goes.

The super-rich, the 'plain rich', the 'poorest' rich...and everyone else

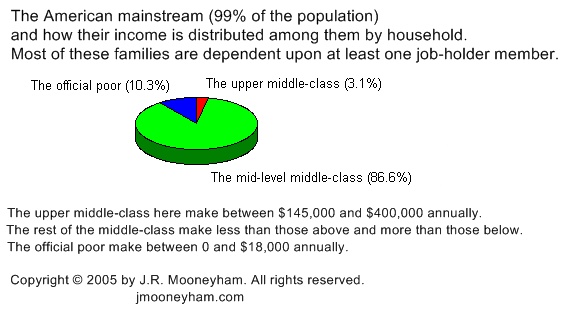

So it appears the official 'poor' are making somewhere between zero and $18,000 a year-- although some experts say quite a few households making considerably more than that should be classified as poor; for example, a single person household making $18,000 a year will likely be less pressed than a family of four to six living on the same income. Where someone lives can also make a huge difference in how far $18,000 goes, in rent or mortgage payments.

Those households making between $18,000 and $145,000 may be considered low to intermediate level 'middle-class', while those making between roughly $145,000 and $400,000 are 'upper' middle-class.

Note that some would argue with my classifications here. For instance, Michael Parenti (cited below) considers $117,500 to be an "upper-middle income", while I say it's just a 'middling' (intermediate level) middle-class income. I base my judgment on personal experience with folks in that income range. It's remarkably easy to find yourself struggling in the modern US economy on $117,500 a year. Frequent moves relating to job changes often cause higher than expected housing and transitional costs, and the ever-growing automobile commutes required from many workers means lots simply can't keep their jobs if their cars get too old or otherwise dilapidated-- so occasional new (or late model) car buys and plenty of maintenance costs can be involved. Two worker families usually have no choice but to own two separate late model cars to get to those jobs. Americans tend to over-rely on credit cards for many contingencies as well, thereby draining their finances with often unnecessary interest charges. And if a couple has kids too, the number and size of unanticipated expenses tend to skyrocket...And so on and so forth...

|

"...the federal poverty level for a family of four in 2002 – about $18,000..."

"Ninety-nine percent of households make less than $374,000" -- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 "127 million tax filers with income below $140,000" -- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times "The typical American household now carries $8,500 in credit card debt" -- A deluge of credit S.F. man tallies credit card offers -- 217 solicitations by David Lazarus; March 7, 2003; San Francisco Chronicle "The top million households had a median income $1.1 million and all earned over $314 thousand" "The top five million households had income in excess of $150 thousand" -- NOW THAT'S POWER by Dave Pollard; How to Save the World; August 2, 2003 "$117,500 is an upper-middle income" -- The Super Rich Are Out of Sight by Michael Parenti; December 27, 2002 |

The vast majority of the households making between zero and $400,000 described above will almost certainly have at minimum one person in the family working at least part-time, to keep the money coming in. And see their income fall significantly if that person loses their job, or suddenly can't work due to illness or injury. A great many of these households will likely have more than one member working to bring in income, and/or one or more members actually holding down two different jobs simultaneously, as well.

|

"The average American today is working longer hours than the people of any other major country on earth"

"The number of Americans working more than one job at a time increased 92% between 1973 and 1997" -- Making Ends Meet; Working Families in the Global Economy; web site of Congressman Bernard Sanders, Vermont's Independent Representative; found on or about 10-18-03 "One in four homeless people were in managerial or professional jobs before they ended up on the streets, according to a new survey by the charity Crisis. Among them are accountants, teachers, engineers and advertising executives." -- Middle-class, professional, homeless By James Morrison; 04 May 2003; Independent Digital; article discussing a British study of the homeless. |

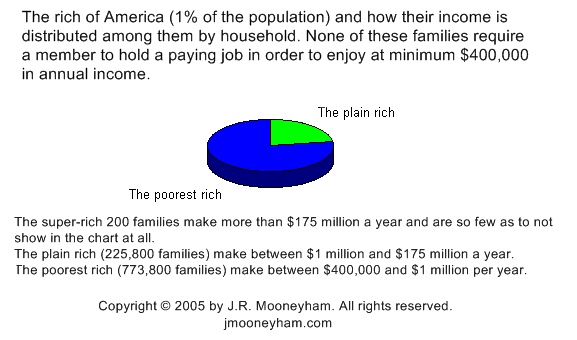

According to our assumptions here, the 'poorest' rich folk make somewhere between $400,000 and $1.1 million per year (and consist of around 773,800 households), while the 'plain' rich make between $1.1 million and $175 million a year (there's perhaps 225,800 of these households in the US). Those households/families each making $175 million or more annually (maybe 200 of these in America), we'll here classify as 'super-rich'.

In all these 'rich' classes, any household in question must be capable of bringing in at least $400,000 a year, even where no one in the household holds a paying job (that's one of our definitions of 'rich', remember). Otherwise they drop down to something nearer the level of the other 99% of households in the country.

A summary of very rough approximations of the fractions of US population fitting into these classifications as of 2003 would include:

The top 1% of income households in the USA:

The super rich: 200 families or households making between $175 million and $1000 million plus ($one billion plus) a year each; these fortunes are "largely inherited"

Famous examples: The super rich usually guard their identities and true net worth zealously, with all the means at their disposal. In some cases this may be due not only to privacy and security concerns, but to shady dealings on their part as well. Which all means even the IRS, FBI, and CIA could have trouble getting much info on them. But on occasion these folks get dragged into public court proceedings by way of a messy divorce or investment scandal, wherein others might learn a few things about them.

This means that usually the only super-rich the public knows much about are those who didn't steal or inherit their fortune, but instead made it from scratch. Those folks usually only succeeded by very public pursuits the whole way, such as being entertainers who became wildly popular through their works.

Circa 2005 George Lucas, Oprah Winfrey, and Mel Gibson may be members of this type of the super rich, income-wise-- but the magazine touting them is vague on their financial prowess. It appears to say they're all making enough to be categorized here. But elsewhere it says the numbers they provide have not had some possibly substantial expenses subtracted from them.

Plus keep in mind that folks in the entertainment industry often drop precipitously in income once their popularity fades. And they enjoy huge spikes in some years due to hit films, songs, etc. So it's by no means a sure thing such folks will retain their place in this rarefied level of wealth indefinitely.

|

-- The Super Rich Are Out of Sight by Michael Parenti; December 27, 2002

"some of the subjects' families 'have been rich for more than 500 years'..." -- Film subjects take exception to 'Born Rich' By Frank Houston - COX NEWS SERVICE/Alameda Times-Star; June 29, 2003 "Some of these private companies have been in family hands for a long while--just shy of 400 years..." -- Private World 11.29.04 by Deborah Orr, Brent Lang, Kiyoe Minami, Ainsley O'Connell, Amanda Schupak, and Cristina Von Zeppelin; forbes.com; another URL for this story at one time may have been "http://story.news.yahoo.com/news?tmpl=story&cid=64&ncid=762&e=13&u=/fo/20041111/bs_fo/69b10ac07c1e9cbe1ec98653fa2d3cd6". Fully 38% of all US wealth is in the possession of only 1% of its population. -- Log cabin to White House? Not any more by Will Hutton; April 28, 2002; The Observer; Guardian Newspapers Limited Billboard's 2008 top moneymaking musicians:

Madonna, 242.2 million U.S. dollars.

-- Madonna the top-earning musician of 2008 February 13 2009; People's Weekly World Newspaper TV Guide: Oprah Earns $385 Million Per Year; August 4, 2008, original URL (now broken): http://www.usmagazine.com/tv-guide-oprah-earns-three-eight-five-million-per-year Bill Gates is listed as the world's richest known man, with a fortune of $40 billion and an annual income from stock dividends alone estimated to be $100 million (efforts to determine Gates' total annual income have so far been unsuccessful; but it's widely known that his net worth rises and falls with the value of Microsoft stock, and that he periodically sells tens of millions of dollars worth of said stock to supplement his other income source(s)). -- Microsoft Millionaires Grapple With Wealth By Blaine Harden; Washington Post; August 3, 2003; Page A01 In 2007, the combined wealth of just six Walmart heirs ($69.7 billion) was equivalent to the total combined assets of the poorest 30% of US citizens (90.6 million people) (or, a group of just six persons had as much money as 90.6 million others, combined). -- The few, the proud, the very rich Sylvia Allegretto, labor economist, Center on Wage and Employment Dynamics | 12/5/11 According to Wolfram|Alpha just before 5:22 PM, 11-22-12, the total US population in 2007 was about 302 million. 30% of that would be 90.6 million. -- Forbes.com Forbes World's Richest People 2003 -- The Celebrity 100 Sorted By Pay Rank; The Celebrity 100; Edited By Peter Kafka, 06.15.05; forbes.com |

The 'plain' rich: about 225,800 families or households making between $1 million and $175 million a year

(226,000 (making $1 million plus a year) minus the super rich yields about 225,800 families or households making between $1 million and $175 million a year each)

Famous examples: Circa 2005 Tiger Woods tops the 'plain rich' celebrity list in annual income. He's followed (in descending order) by folks like Steven Spielberg, Dan Brown, Madonna, Peter Jackson, Elton John, David Letterman, Will Ferrell, Oscar De La Hoya, Johnny Depp, Ray Romano, P Diddy, Will Smith, Shania Twain, Shaquille O'Neal, Michael Jordan, Tobey Maguire, Tom Cruise, Howard Stern, Rod Stewart, Jay Leno, and Rush Limbaugh.

All the above folks made $30 million or more in at minimum a single year, and so could conceivably retire rich for life immediately, as defined on this page.

|

"The group with incomes over $1 million — which consists of about 226,000 tax filers in 2003"

-- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times "The top 0.1 percent of Americans had an average annual income (not assets, but income) of $3 million in 2002..." -- White House Watch: Ann McFeatters / Bursting America's bubble Class trends are heading the wrong way by Ann McFeatters; August 07, 2005; post-gazette.com "Last year, the Forbes 400, the ones the magazine knows about, listed 267 Americans with a net worth of more than $1 billion. Professor Edward Wolff of New York University, a student of such things, figures the number of households with a net worth of more than $10 million stands at more than 350,000, probably more than the number of households in Seattle!" -- Surdna Foundation: The Promise of Venture Philanthropy; accessible online on or around 8-25-05; surdna.org -- The Celebrity 100 Sorted By Pay Rank; The Celebrity 100; Edited By Peter Kafka, 06.15.05; forbes.com NEW NUMBERS CIRCA 2005: "The number of Americans making that much [$1 million or more] fell by 12 percent, to 181,300 taxpayers in 2003, from 205,124 in 1999. Their average income fell, too, to just under $3 million, a decline of more than $572,000, or 16 percent." -- Income Down From 1999, Tax Data Show By DAVID CAY JOHNSTON; September 28, 2005; nytimes.com BUT ARE THESE NEW NUMBERS MORE ACCURATE OR LESS ACCURATE THAN PREVIOUS ONES? "While wage earners have every dollar of income reported to the government, the super rich control what the IRS knows about their incomes. But the rich are rarely audited anymore. Congress also gives them many perfectly legal devices to defer reporting income for years or decades. That means that the real incomes of the super rich are much larger than the IRS data show and their tax burden is even lighter." -- Stroke the rich IRS has become a subsidy system for super-wealthy Americans IRS winks at rich deadbeats by David Cay Johnston; April 11, 2004; sfgate.com "The figures at the top may be misleading, though, because the I.R.S. is much more accurate in capturing wage income than income from businesses and investments." "In addition, a sharp decline in audits combined with the marketing of devices to help people understate their true income make figures for the highest nonwage incomes less reliable. Generally these strategies, which range from the little known but legal to criminal tax evasion, do not work for wage earners." -- Income Down From 1999, Tax Data Show By DAVID CAY JOHNSTON September 28, 2005; nytimes.com |

The royal family of Britain isn't an American example, but offers a high profile illustration of the level of luxury and security folks in this group can be accustommed to. Prince Charles alone gets close to $17 million a year.

J.K. Rowling (author of the Harry Potter books), as well as Queen Elizabeth of Britain appear to belong to this group-- albeit with the same caveats regarding the differences between 'net worth' and 'annual income' mentioned before for Bill Gates.

US Vice President Cheney is an American example of this class, reporting adjusted gross income in 2002 of $1.2 million.

|

-- President discloses at least $8.8 million in assets in 2002 Vice President reports worth of at least $19 million By Deb Riechmann; Associated Press;

May 17, 2003; The Daily Camera

-- How much does the U.S. president get paid? -- Prince Charles' Income Is Nearly $17M; The Associated Press/ABC News; June 29, 2003 The net worth of J.K. Rowling and Queen Elizabeth is estimated to be at $444 million and $397 million, respectively. -- J.K. Rowling Estimated Richer Than Queen; The Associated Press/ABC News; April 27, 2003 |

The 'poorest' rich: around 773,800 families or households making between $400,000 and $1 million a year

(one million (making $314,000+ a year) minus 226,000, minus 200, yields 773,800 families or households making roughly between $400,000 and $1 million a year each)

|

"in 2000 there were nearly 2.8 million "high-income" returns, those with adjusted gross income of at least $200,000"

-- IRS report shows rich getting richer, faster; June 26, 2003; CNN/Money "The top million households had a median income $1.1 million and all earned over $314 thousand" -- NOW THAT'S POWER by Dave Pollard; How to Save the World; August 2, 2003 "...the top 1% – that million or so families..." -- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 "The group with incomes over $1 million — which consists of about 226,000 tax filers in 2003" -- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times "Last year, the Forbes 400, the ones the magazine knows about, listed 267 Americans with a net worth of more than $1 billion. Professor Edward Wolff of New York University, a student of such things, figures the number of households with a net worth of more than $10 million stands at more than 350,000, probably more than the number of households in Seattle!" -- Surdna Foundation: The Promise of Venture Philanthropy; accessible online on or around 8-25-05; surdna.org |

Famous examples: US President George W. Bush qualifies at the very least for this class, depending on certain details regarding his income which I'm not privy to at the moment-- as he reported adjusted gross income in 2002 of $856,000. If Bush doesn't belong to this group, then he likely qualifies instead for the 'plain' rich class, described earlier. Note that Bush and Cheney are allowed by law to be somewhat vague about their true financial status, so their true income may be considerably higher than what's indicated by the released AGI numbers. For example, Bush was able to report that his net assets are at least $8.8 million, but possibly as much as $21.9 million.

Keep in mind though to qualify as rich here, both Bush and Cheney would have to get at minimum $400,000 in income even if they held no paying jobs. So what do they make as President and Vice President respectively? $400,000 and $181,400. Which, subtracted from their AGIs, leaves $456,000 and $1,018,600. So yes, they'd still qualify as rich even unemployed, it appears.

|

-- President discloses at least $8.8 million in assets in 2002 Vice President reports worth of at least $19 million By Deb Riechmann; Associated Press;

May 17, 2003; The Daily Camera

One source indicates a $400,000 yearly salary for US President as of 2001(!), which doesn't include other niceties like an expense account, mansion with underground nuclear war bunker for housing (the White House), vacation retreat (Camp David), and about all the servants that could work in a practical manner in the vicinity around them. The Vice President gets $181,400 plus a $10,000 expense account. |

Other famous examples of the 'poorest' rich can be drawn from a great many of our other politicians in high places, like the US House of Representatives and Senate. It appears almost all of these who happen to be rich rate mostly in the 'poorest rich' category, with perhaps a sprinkling of much fewer 'plain rich' among them. And yes, there are some Representatives and Senators who are not rich.

| -- Table 1 Estimated Wealth and Possible Estate Tax Liability of Wealthiest Members of Congress; News - Strauss & Associates, P.A. - Estate Planning, Medicaid, Asset Protection - North Carolina by Martin A. Sullivan; accessible online on or around 10-6-05; strausslaw.com |

More details about the richest 1%:

|

"The top 1 percent own almost 40 percent of the wealth–compared with less than 13 percent 25 years ago."

-- What kind of capitalism? By Juan T. Gatbonton; manilatimes.net; July 6, 2003 "The financial wealth of the top one percent of Americans now equals that of the bottom 95%" -- Frank Talk on Free Trade by Jeff Gates, President of the Shared Capitalism Institute; SustainAbility Radar March 2000 "the top 0.2 percent of tax filers would receive nearly as much from the tax cut as the bottom 95 percent of filers combined" -- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times |

The bottom 99% of income households in the USA:

The upper middle-class: four million families or households making between $145,000 and $400,000 a year

(5 million (making $150,000+ a year) minus 773,800 (the poorest rich), minus the plain rich (225,800) minus the super-rich (200) yields roughly some 4,000,200 families or households making between $145,000 and $400,000 a year each)

The low to intermediate level middle-class: 113.5 million families or households making between $18,000 and $140,000 yearly

(127 million (making less than $140,000 annually) minus the poor 13.5 million families or households (making around $18,000 or less)) that make somewhere between $18,000 and $140,000 yearly)

The official poor: 13.5 million families or households making between zero and $18,000 a year

|

As there's apparently 127 million tax returns filed for under $140,000 in income, and five million filed for incomes above that, that makes for a total of around 132 million US tax returns overall. As the average size of a US household is somewhere between two and three members, and total population is some 290 million in 2003, we might expect the total number of US households to range somewhere between 97 million and 145 million. So using the total number of separate US tax returns as the rough total US household number would not necessarily be unreasonable. Therefore, until I get better figures I'll assume that the total number of households in the US is around 132 million.

In 1999 there were estimated to be 32.3 million officially poor Americans. This would work out to between 11 million and 16 million poor households. Or 8% to 12% of the total. This 8-12% fits within the estimate that 37% of US households make under $25,000 a year, as $18,000 is considered one of the poverty thresholds. Let's split the difference and say there's some 13.5 million poor US households in 2003. US population was estimated to be 290,342,554 in July 2003. -- CIA - The World Factbook -- United States; referenced on or about 8-17-03 -- 'The total number of households in 2000 is 121606 thousand' (or 121.6 million US households in 2000) "127 million tax filers with income below $140,000" -- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times "the federal poverty level for a family of four in 2002 – about $18,000..." -- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 "16 percent of the population under the age 18, lived in poverty in 2000" -- Food supply and nutrition education for children; 7-Jul-2003; Contact: Bridget McManamon; bmcmana@eatright.org; American Dietetic Association "The number of poor people dropped to 32.3 million in 1999 from 34.5 million in 1998" -- U.S. Poverty Rate at 20-Year Low, Report Says By Sue Pleming; September 26, 2000; Yahoo! Inc. "The household size of the average American family declined from 3.1 to 2.6 persons during the last 30 years and will reach 2.35 by 2020" -- 068 demographics.R1.qxd-i; found on or about 8-17-03 "Ninety-nine percent of households make less than $374,000" -- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 "in 2000 there were nearly 2.8 million "high-income" returns, those with adjusted gross income of at least $200,000" -- IRS report shows rich getting richer, faster; June 26, 2003; CNN/Money "The top million households had a median income $1.1 million and all earned over $314 thousand" "The top five million households had income in excess of $150 thousand" -- NOW THAT'S POWER by Dave Pollard; How to Save the World; August 2, 2003 "those with the top 400 incomes (IRS year-2000 figures), averaged $174 million" "the top 1% – that million or so families" -- Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 "The top 400 households in the US had a median income of $175 million per year" -- NOW THAT'S POWER by Dave Pollard; How to Save the World; August 2, 2003 "The group with incomes over $1 million — which consists of about 226,000 tax filers in 2003" -- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times |

Though it may be unnecessary to call attention to this particular point, I'll do it anyway: Notice that here we're NOT going to classify someone such as the Publisher's Clearinghouse sweepstakes winner mentioned before as rich. Because although they'll likely be able to quit their job and live on their winnings until they die (so long as they are especially careful how they spend or invest it in the first few years) their expected annual income for years to come won't be enough to reach the $400,000 mark, or ten times more than the income of the average $40,000 a year household, as laid out before.

So sorry, but even winning a much vaunted Publisher's Clearinghouse Sweepstakes will NOT make you rich-- at least by the standards listed here.

Another interesting point here may be that your daily work and officially recognized value to society in general may have little bearing on your income or net assets, so far as becoming rich is concerned (at least wherever that effort doesn't directly produce a profitable industrial or commercial product or service). For instance, winning a Nobel or Pulitzer Prize, or MacArthur Foundation Award, though prestigious and financially rewarding, won't make the recipient even close to being rich, in and of themselves. Qualifying as rich entails much more than a one-time spike to the bank account: A regular annual income of around $400,000 or more-- without the need to work for it-- is key.

So sorry again, but winning the likes of a Nobel Prize, or Pulitzer, or MacArthur Foundation Award will NOT make you rich, either.

|

The Nobel Prize for Literature in 2000 was about $1 million.

It appears in some cases multiple winners will split a single Nobel Prize cash award (i.e., $1 million might be split six ways) -- Australian Nobel Prize Winners John D. and Catherine T. MacArthur Foundation fellowships or 'Genius Grants' amount to about $300,000 each, plus free health insurance, dispensed over a five year period. Award amounts can vary depending upon your age. The older the recipient, the larger the amount. -- American Philanthropy: The MacArthur Foundation Fellows and Historian of American labor wins MacArthur award by Beth Thomas Pulitzer prizes amount to around $5000 each. -- The Value of Book Awards "Cash awards of $5,000 in each category" (pulitzer) |

So how do the newly rich attain their wealth? And what's the average American's chance of ever getting rich?

It turns out wealth is a legacy thing for the most part. That is, you're either born into it, or you're not. Or you marry a rich person. It's a family matter.At least that's so for more than two-thirds of the truly rich. Of the remainder, most screw over the rest of us to get there, in various unethical operations or outright criminal conduct. For which they usually never get caught-- or if they do, they rarely get much in the way of punishment for their deeds.

Then there's the handful of a given generation who manage to be in the right place at the right time to make their wealth honestly. Such as the founders of Apple Computer in the seventies. But such opportunities are apparently rare. And if not handled just right, the wealth generated by them can evaporate as fast as it appeared, causing many of the honest fortune makers to fall back to income levels similar to the rest of us once again.

The ephemeral nature of many fortunes generated or reaped by honest newcomers to the class may be one factor which helps inheritance, marriage, and crime retain their spots as primary sources of long term wealth gains in America.

To see details on this matter check out How to get rich in America. Want references with your info? Then go to How to get rich in America REFERENCE

How badly are the 'poorest' rich hurt by income taxes?

But let's return to the 'poorest' rich folks again: the $400,000 a year possibly unemployed. That $400,000 a year is before taxes. So with the 'huge' tax burden those poor folks suffer from (as Republicans constantly tell us), their income probably drops sufficiently to knock them down to something closer to the status of the rest of us, right?

Well, let's see. Just exactly how much pre-tax income does a household require to have to pay the top tax rates these days?

First of all, keep in mind here that there's oodles of legal tax dodges available for truly wealthy folks, and many subscribe to the services of accountants and tax lawyers to make sure they milk every one of them they can. So there's a good chance that quite a few of these folks pay no income taxes at all-- at least during some years and situations.

Just one way the rich can often reduce their taxes is to incorporate themselves or their holdings.

Fully 25% of all world economic activity and value appears to be concentrated in just 200 corporations, which combined employ less than one percent of the labor force worldwide; Over half of the 100 largest economies on Earth are now corporations rather than nations.

|

51 of the 100 biggest economic bodies in the world are now corporations rather than nations. Over 25% of the global economy is based upon only 200 corporations, which altogether employ under one percent of the world's labor force.

From 1983 to 1999 profits of the 200 companies described above increased by over 360%. 82 of the 200 companies are USA corporations. 41 are Japanese. Seven of the US companies actually received net tax credits from the federal government rather than paying any taxes for 1998. 44 of the 82 US companies paid less than the 35% federal income tax normally required between 1996 and 1998. -- Study Reinforces Public Distrust of Corporations, the Institute for Policy Studies, found on or about 12-14-2000 -- Corporate tax avoidance is costing us all billions by Nick Mathiason; June 29, 2003; The Observer |

But we'll ignore all those possibilities here.

According to the 2002 World Almanac, the top individual tax rate for any and all taxable income over $297,350 for most categories was 39.1%. If married couples filed separately, the 39.1% kicked in at $148,675 per spouse. Estates and trusts were only taxed by 27.5% for taxable income generated between $1,801 and $4,250. For less than $1801, the tax rate was 15%.

| -- The World Almanac and Book of Facts 2002, page 152; World Almanac Books |

Let's assume a worst case scenario for the $400,000 crowd, where for some reason they cannot or do not take advantage of the numerous loopholes provided in tax law by the government to shield high incomes from taxes. Plus, in a world class dumb mistake they also fail to take any of the various standard deductions which are available to most all tax payers, and in a compound error the IRS too fails to notice the mistake and recalculate their taxes to a lower figure. What would be the bad news for the $400,000 before tax crowd in this worst-case scenario?

The poor dears! Their annual income would indeed drop precipitously-- all the way down to a bit below the $260,000 annual income that the Publisher's Clearinghouse Sweepstakes winner described earlier would realize-- or $243,600 to be precise.

Of course, this is $243,600 after taxes for the $400,000 household-- which means it's a lot more than a real PCH winner in these circumstances would end up with.

So they're still better off than a $40,000 before tax household which won the sweepstakes!

But what about their lifestyle? Would they be forced to get a job? What of their three fancy houses and four luxury autos? Wouldn't they have to give some of them up? Nah on all counts. Their worst case scenario $156,400 tax bill would consume pretty much all their $160,000 'throwaway' money though. So you can expect that by golly next year they wouldn't make the same whopping mistakes with their tax returns!

Of course, if I'm interpreting the figures right, and the $400,000 folks actually got all their money from a trust or estate income instead, then they'd only pay as much as $1,169 (0.3%!) and keep $398,831 in the worst case. Or pay practically negligible income taxes at all.

[AUTHOR'S NOTE: Surely this last item isn't correct(?) as it sounds too outrageous! Paying less than one third of one percent income taxes on $400,000? Anyone who knows better please email me with the details! Until I hear from you, I'll continue looking into the matter on my own...END NOTE]

|

"Next year, the lucky heirs can get $1.5 million tax-free. This figure becomes $2 million in 2006 and $3.5 million in 2009. Then, in 2010, you can leave them an unlimited amount"

-- No Way to Plan, Thanks to Uncle Sam By Ric Edelman; July 6, 2003; Page B01; The Washington Post |

So today's tax rates pose no significant threat even to rich folks who are completely incompetent at tax preparation-- and still less to those who aren't.

Indeed, even the highest top income tax rates in modern US history apparently didn't harm the long term rich folk-- as their fortunes have weathered literally centuries of all sorts of tax rates, recessions, depressions, incompetence on the part of the holders and their advisors, and more.

|

"some of the subjects' families 'have been rich for more than 500 years'..."

-- Film subjects take exception to 'Born Rich' By Frank Houston - COX NEWS SERVICE/Alameda Times-Star; June 29, 2003 Nations have often grew rapidly economically with higher top tax rates than 46%. The US had a top tax rate of 70% in the 1960s and had "...its most prosperous decade ever...". -- ITALY; ECONOMICS REPORTING REVIEW: The NYT and the Washington Post Under the Microscope [possibly by Dean Baker] Week of October 28 - November 3 (found on or about 11-5-00), citing "Italy's New Politics: The Beauty Contest," by Alessandra Stanley in the New York Times, October 30, 2000, page A6; [TOMPAINE.com: ECONOMICS REPORTING REVIEW may be the original link] "...from 1979 to 1997, the average annual income of the top 1% (after taxes) increased by 157%, or $414,000 in 1997 dollars. Over the same period, the income of the poorest 20% fell by $100" Astronomical Incomes By Stan Cox, AlterNet July 31, 2003 |

So how would our modest single home two car $40,000 working household fare under the same worse case scenario in tax return preparation?

Married, filing jointly, the tax rate would be 15%. Head of household, 27.5%. So the after tax money would be $34,000 or $29,000, respectively.

| -- The World Almanac and Book of Facts 2002, page 152; World Almanac Books |

Hmmm. Seems to me our $40,000 a year working folks could feel quite a pinch here, ending up with as little as $29,000. While the $400,000 folks could in the worst case above still be comfortably unemployed and living with three houses and four cars, each of which worth twice the similar assets owned by the $40,000 before tax employed household.

But remember: according to many conservative politicians we're supposed to believe the $400,000 folks are the ones with the incredibly unjust tax burden here. So the $400,000 folks should get tax cuts, while $40,000 folks get tax increases.

According to many Republicans, households making less than $75,000 a year simply have too much money and receive more than their fair share in government services. But households making between half a million and one thousand millions of dollars a year don't have enough money or government services to get by

|

Apparently US-based right-wing parties circa 2002 believe the poor should be made still poorer (and the rich richer) through changes in tax policies.

-- Low-Income Taxpayers New Meat for the Right (washingtonpost.com) By E. J. Dionne Jr.; November 26, 2002; Page A29 Some conservatives say social security taxes on the lowest 99% income folks shouldn't count when tallying up their tax burden.

"The president is making the case that people who earn between $50 [thousand] and $75,000 a year should be paying a third more taxes...I'd love to debate him on that" -- Rep. Robert T. Matsui (D-Calif.)-- New Tax Plan May Bring Shift In Burden By Jonathan Weisman; Washington Post; December 16, 2002; Page A03 -- Bush camp studying whether wealthy bear too much of tax load By Jonathan Weisman, The Washington Post; Seattle Times; December 17, 2002 -- Meme Watch: Bushies Take the Bait - The tax-the-poor movement picks up steam. By Timothy Noah By Timothy Noah; December 16, 2002; Slate -- The war on the poor by E.J. Dionne, Jr.; 02.07.03; Working Assets -- Bush seeks stiffer aid rules for poor By ROBERT PEAR; Feb. 6, 2003; New York Times/HoustonChronicle.com -- Bush Seeks to Recast Federal Ties to the Poor (washingtonpost.com) By Amy Goldstein and Jonathan Weisman; February 9, 2003; Page A01 The US government now appears it will be mired in budget deficits at least through 2005, if not longer, according to a National Press Club speech by President Bush's budget director, Mitch Daniels. Daniels says the deficits should be handled by cutting the budgets of social programs, and forcing annual Congressional votes (and opportunities for more cuts) even for the continuing operation of programs like Social Security, Medicare, and Medicaid. -- Media War Horses Aim for the Front Lines By Howard Kurtz; Washington Post; November 30, 2001 |

The top 22.6% of the wealthy (the richest of the rich) often aren't even included in many statistical analyses-- which means the results of such reports are misleading at best

Perhaps the single item about all this research and analysis that surprised me the most personally was the realization that many, maybe most, government and think tank studies on American economics performed over many years completely ignored everyone classified as rich in this document, including the 'poorest' of the rich, at $400,000 a year.

Of course, such a lengthy period and large number of 'tainted' study results means that many of the quotes you may hear from politicians from such studies regarding wealth equity and the middle-class could be highly deceptive and misleading, at best, and outright lies at worst. For when you chop many of the richest people out of the statistics entirely and then imply the highest earners of what's left are the richest folks around, that's basically lying.

|

Until 1994, the U.S. Census Bureau simply didn't gather the same info on folks making over $300,000 a year as they did everyone else. Beginning in 1994, they raised the bar to $1 million-- so now everyone making over $1 million a year are often ignored and left out of many economic reports and analyses.

-- The Super Rich Are Out of Sight by Michael Parenti; December 27, 2002 |

So who would benefit most from this appalling fudging of the stats?

From all the research I've done it seems such deceptions would usually benefit liberal and independent politicians the least, and conservatives the most. For it's the conservatives who most often use such massaged figures to claim their policies are helping the middle-class, when more often it's the rich hidden behind the statistical curtain who get the lion's share of everything.Of course, this practice would also generally help out any and all already wealthy politicians of all parties who desire to sneak past the public special legislation which effectively cuts their own (the politicians' themselves) taxes more, and the taxes of the poor and middle-class less (if at all).

|

-- President discloses at least $8.8 million in assets in 2002 Vice President reports worth of at least $19 million By Deb Riechmann; Associated Press;

May 17, 2003; The Daily Camera

"Without counting outside sources of income, the earnings of members of Congress rank within the top 5 percent of the nation" -- House to Vote on Pay Raise for Lawmakers By JIM ABRAMS, Associated Press/Yahoo! News; Sep 04, 2003 -- Senate remains a rich man's -- and woman's -- club, finances show BY ALAN FRAM; Associated Press/Miami Herald; Jun. 14, 2003 -- Dividend Tax Cut Will Benefit Many in House, Financial Reports Show (washingtonpost.com) By Juliet Eilperin; June 17, 2003; Page A03 -- Reports show senators' holdings in oil, drug industries By Dan Morgan; THE WASHINGTON POST/The Austin American-Statesman; June 14, 2003 |

This strategy, where successful, largely pits the middle-class voters against the poor-- basically splitting that traditionally Democratic vote, and thereby strengthening Republicans at the polls.

|

-- Property Taxes Are Coming to Get You By Betsy Schiffman, Forbes.com/ABCNEWS.com; May 14, 2003

-- Repeal of estate tax to increase tax burden and widen wealth gap; EurekAlert! 24-Feb-2003; Contact: Johanna Ebner or Lee Herring; pubinfo@asanet.org; 202-383-9005 x332; American Sociological Association -- Middle Class Tax Share Set to Rise (washingtonpost.com) By Dana Milbank and Jonathan Weisman; June 4, 2003; Page A01 -- Year-by-Year Analysis of the Bush Tax Cuts Shows Growing Tilt to the Very Rich; Citizens for Tax Justice , 202-626-3780 June 12, 2002 -- Helping Fat Cats Dodge the Taxman By Louis Lavelle; JUNE 20, 2002; Businessweek "Poorest 80 percent will receive less than 10 percent of new tax breaks" -- The Seriously Dumb Tax Cut by Molly Ivins; Creators Syndicate; 01.07.03 "Middle-class families pay income tax on their earnings at a rate of up to 25%, plus another 7.65% in payroll tax. Yet under the law President Bush just signed, a CEO who pays himself whatever he wants can sell millions of dollars in stock and pay tax at a total rate of 15%" -- John Edwards, 2004 presidential candidate -- The Proletarian Ethic and the Spirit of Capitalism By William Saletan; June 20, 2003; Slate "IRS says growing wealth for 400 top taxpayers outstripped increases in their tax burdens." -- IRS report shows rich getting richer, faster; June 26, 2003; CNN/Money "...the rich paid less of their income in federal income tax in 1999 than in 1995. And...the tax cuts already passed or proposed by President Bush are likely to lower the tax burden of the wealthiest families further." -- Tax-justice watchers tweak loophole on capital gains By David R. Francis; The Christian Science Monitor; February 19, 2002 edition "Between 1983 and 1995, the inflation-adjusted net worth of the top 1% of the U.S. population grew by 17%, while the bottom 40% of American families lost 80% of their worth" "the average annual incomes of the poorest 20% of families actually fell by 5%" -- Who's Winning? and The Wage Gap; Working Families in the Global Economy; web site of Congressman Bernard Sanders, Vermont's Independent Representative; found on or about 10-18-03 "The wealth of the Forbes 400 richest Americans grew an average $940 million each over the past two years" -- Frank Talk on Free Trade by Jeff Gates, President of the Shared Capitalism Institute; SustainAbility Radar March 2000 "Meanwhile, the top 400's tax burden plunged from 26.4 percent to 22.3 percent, on average...All this was before two rounds of Bush tax cuts skewed toward the wealthy. If the latest cuts had been in effect in 2000, the average member of the 400 would have saved another $8.3 million in taxes, bringing the tax rate down to just 17.5 percent." -- UP, UP AND AWAY; Media Roundup By Caleb Hellerman; INEQUALITY.ORG; July 1, 2003 "95 percent of households take in less than $150,000 a year" -- Astronomical Incomes By Stan Cox, AlterNet; July 31, 2003 -- New Tax Plan May Bring Shift In Burden By Jonathan Weisman; Washington Post; December 16, 2002; Page A03 -- Bush camp studying whether wealthy bear too much of tax load By Jonathan Weisman, The Washington Post; Seattle Times; December 17, 2002 -- Meme Watch: Bushies Take the Bait - The tax-the-poor movement picks up steam. By Timothy Noah By Timothy Noah; December 16, 2002; Slate |

These same highly 'spun' stats make it appear that the upper middle-class of America are the actual rich, when they really may often make as little as 36% of what the 'poorest' truly wealthy households do-- and have to work for their living to boot, when the true rich don't.

Wherever the middle-class can be duped into believing this deception as true, they will naturally sympathize more with many Republican proposals targeted to benefiting the wealthy-- as according to the massaged reports the middle-class themselves are the wealthy!

Vanity accelerates the decline of the American middle-class

There's also the human frailty of pride involved in all this of course: just as many folks actually living below the poverty line in the US will often classify themselves as 'middle-class' in surveys, many of the middle-class themselves like to think they instead belong to America's 'upper-crust', thereby perhaps sharing tax brackets with some of their favorite celebrities, if not actually rubbing elbows with same. So some of the success of this particular deception boils down to personal vanity. In the Keanu Reeves film The Devil's Advocate, the devil says his favorite weakness in his prey is vanity (paraphrased).

|

-- The Super Rich Are Out of Sight by Michael Parenti; December 27, 2002

"Ninety-five percent of U.S. households have incomes between zero and $150,000" -- Astronomical Incomes By Stan Cox, AlterNet; July 31, 2003 "127 million tax filers with income below $140,000" -- Bush's high crimes against the nation By Walter Williams; August 01, 2003; Seattle Times |

The deception only gets worse when you include the 'super' rich in the considerations.

In effect, it appears American conservatives have succeeded at utterly removing all but the 'poorest' rich from the ongoing politics of 'class warfare', leading the poor and middle-class to mostly fight amongst themselves for whatever economic scraps are left over after conservatives hand the bulk of American prosperity to those who are and were already wealthy beyond the ken of the rest of us.

I do have to admit that this Republican strategy is one of the slickest and most difficult to defend against that I've ever seen. But of course it took them at least 40 years of preparation and fine tuning to get it to this point-- and the terrorist attacks of 9-11-01 helped the Republicans tremendously as well.

|

Only around 50% of eligible US voters actually vote anymore. The decline in participation in the process has been occuring for 40 years. Voters in other western democracies apparently have more trust in their systems than Americans in their own, as turnout there is typically higher than in the US. Deteriorating quality in education and a reduction of involvement in local communities are some of the reasons experts give for this state of affairs.

-- Experts Alarmed at Declining U.S. Voter Turnout By Will Dunham; Yahoo!/Reuters; November 5, 2000 "The conservative think tanks have worked for 40 years now, developing not just language, but modes of thought that the language fit." -- George Lakoff, professor, department of linguistics, University of California, Berkeley, and author of Moral Politics -- Left Out By Right Rhetoric; an interview of George Lakoff by Sharon Basco; May 08 2003; TomPaine.com

"For five decades....the biggest bargain around...[was]....political influence. For many a year, it was far cheaper than anything to be found in the stock market."-- Warren Buffett, Berkshire Hathaway Inc., 2000 -- The Billionaire's Buyout Plan By WARREN E. BUFFETT; September 10, 2000; The New York Times Company "The new Politics of Terrorism have immensely strengthened the political standing of George W. Bush" "The new politics of terrorism also revive the issues that have naturally favored Republicans" -- Inevitably, The Politics Of Terror By E.J. Dionne Jr.; washingtonpost.com; May 25, 2003; Page B01 -- 9-11 boosted trust in government, temporary distress, research shows; 9-Jun-2003; Contact: David Williamson; 919-962-8596; University of North Carolina at Chapel Hill "some of the subjects' families 'have been rich for more than 500 years'..." -- Film subjects take exception to 'Born Rich' By Frank Houston - COX NEWS SERVICE/Alameda Times-Star; June 29, 2003 -- Year-by-Year Analysis of the Bush Tax Cuts Shows Growing Tilt to the Very Rich; Citizens for Tax Justice , 202-626-3780 June 12, 2002 -- Helping Fat Cats Dodge the Taxman By Louis Lavelle; JUNE 20, 2002; Businessweek -- Class war in America continues by Max Castro; Miami Herald; Jun. 03, 2003 -- The Return of Class War - Bush and the new tyranny of the rich. By Michael Kinsley; June 5, 2003; Slate.msn.com "FICA, of course, is infamously regressive, as the rate drops from 7.65 percent to 1.45 percent on income above $87,000 a year. Sales taxes don't change based on the payer's income, and neither do alcohol taxes, gasoline taxes or most state income taxes. Actually, once all taxes are taken into consideration, those Americans whose incomes are in the bottom 20 percent pay a larger portion of their earnings in taxes than the average American -- and only the top 20 percent pays more." "So as federal taxes go down, state taxes go up -- and the regressive nature of state taxes means that the tax burden is shifted more and more onto those with lower incomes" -- Tax Baselessness In search of those non-taxpayers the right keeps talking about By Aaron Schatz; 6.6.03; The American Prospect "the huge gap in income among Americans, the widest of any major country" "distribution of wealth is even more unequal than the distribution of income. In 1998, 47.3 percent of households' "net financial assets" resided with the top 1 percent of Americans" "is it class warfare to talk about fairness?" "Income inequality in the United States is now not only at a record level and not only the greatest since we began measuring it -- it is also on a par with that of a Third World country" -- Inured to Inequality By Steven Rattner; Washington Post; June 16, 2003; Page A23 "In 1999, the average after-tax income of the middle 60 percent of Americans was lower than in 1977. The 400 richest Americans between 1982 and 1999 increased their average net worth from $230 million to $2.6 billion, over 500 percent in constant dollars." -- Loose grip on reality by Molly Ivins; Creators Syndicate; 08.12.02 and If you want to talk about class warfare ... by Molly Ivins; Star Telegram; Aug. 15, 2002 "Democrats are just scared to be accused of class warfare" -- a Senate Democratic tax aide -- Bush Blunts 'Fairness Question' on Taxes By Jonathan Weisman; Washington Post; May 13, 2003; Page A06 "One of the Republican Party's major successes over the last few decades has been to persuade many of the working poor to vote for tax breaks for billionaires." -- November 03, 2004 Living Poor, Voting Rich; Statistical Modeling, Causal Inference, and Social Science: Living Poor, Voting Rich citing 11/03/04 NY Times by Nicholas D. Kristof; stat.columbia.edu; "http://www.nytimes.com/2004/11/03/opinion/03kris.html?ex=1100149200&en=ea3ae1be1096855e&ei=5058&partner=IWON" may have been another URL for this item at one time. "The Republicans are smarter...They've created...these social issues to get the public to stop looking at what's happening to them economically....What we once thought - that people would vote in their economic self-interest - is not true, and we Democrats haven't figured out how to deal with that." -- Ted Kulongoski, Democratic governor of Oregon -- November 03, 2004 Living Poor, Voting Rich; Statistical Modeling, Causal Inference, and Social Science: Living Poor, Voting Rich citing 11/03/04 NY Times by Nicholas D. Kristof; stat.columbia.edu; "http://www.nytimes.com/2004/11/03/opinion/03kris.html?ex=1100149200&en=ea3ae1be1096855e&ei=5058&partner=IWON" may have been another URL for this item at one time. |

But do we have any other information relating to this issue? Such as how the rich tend to spend any new money they might get, through any means, including tax cuts? Well, we have anecdotal evidence that they sometimes use it toying with vices of various sorts, like gambling, polygamy, or personal vanity (as in building monuments to themselves, or buying business suits costing more than some folks' new cars), and upon death will it to pets rather than human beings...

|

-- Millionaire's Double Life Stuns Family The Associated Press/ABC News; Aug. 12 2003 and Millionaire Raises Two Families 20 Miles Apart; August 13, 2003; The Associated Press/RedNova News -- A Look at the Divorces of the Rich By Davide Dukcevich, Forbes.com/ABCNEWS.com; Oct. 11, 2003 -- Rich Spending Fortunes on Tombs By Mary Foster; Washinton Post; July 6, 2000 -- British Cat Inherits Widower's EstateThe Associated Press/ABC News; May 6; 2003 "...[wealthy high profile conservative William Bennett] had lost as much as $8 million over the past decade playing video poker and high-dollar slots..." -- Bennett says he set bad example, will quit gambling by Mimi Hall USA TODAY/Yahoo! News; May 06, 2003 -- Bush's Suits Cost $2,000 to $14,000 A BUZZFLASH READER COMMENTARY; December 6, 2002; citing Stitch in time produces new classic; Chicago Sun Times May 6, 2001 by Lisa Lenoir and Bush Inaugurated In Oxxford!; October 2003 |

But there's also anecdotes about certain of the wealthy giving to charities. Let's ignore for the moment the fact that such donations are often tax deductible, and so may end up not costing the rich a cent-- allowing the rich to basically just divert money that'd otherwise go to government coffers to their own preferred destinations instead. We'll also ignore how the positive public relations relating to such donations can help the giver get still richer by selling more products and services to customers who hear of their generosity, and get better treatment (like lower taxes or lower real estate prices) in local business and government dealings, and more public support for various lobbying efforts in Congress and elsewhere (which may serve to lower their future taxes and so reduce their charitable giving, or put their competitors out of business).

Of course, wherever such rich folks/corporations strive mightily to keep secret or private such contributions, or give to causes which will not directly or indirectly help their own bottomline or reputation in some fashion, there would seem to be far fewer strings or caveats attached to the donations themselves, making their generosity appear far more honestly benevolent.

In general, it appears the top one percent of folks are not nearly as generous or altruistic as we (the other 99%) are.

|

"82 percent of the money donated by individuals in this country comes from people with incomes under $60,000"

-- 15 Ways To Practice The Art Of Philanthropy by William Upski Wimsatt When you learn that "the financial wealth of the top one percent of Americans now equals that of the bottom 95%", the above statement becomes downright astonishing, in the glaring difference exposed between the financial classes in charitable giving. Plus, as donations can only be tracked for those itemizing on their tax returns, that means much of the charity by lower income households likely isn't even included in the stats-- while virtually everything from the top earners should be. "The financial wealth of the top one percent of Americans now equals that of the bottom 95%" -- Frank Talk on Free Trade by Jeff Gates, President of the Shared Capitalism Institute; SustainAbility Radar March 2000 "Taxpayers who don't itemize can't write off charity donations, and there is no reliable way to measure their donations" -- Study Finds Salt Lake City Area Residents Most Generous in Charity Giving; Hartford, Conn Is the Lowest; ABC News /The Associated Press; April 28, 2003 |

But perhaps being greedy or stingy are necessary components for building massive fortunes? Many wealthy families over the generations have even made it a virtual rule to marry cousins rather than wholly unrelated folks, in order that their wealth and power would not be 'spread around' or shared in that way (among other possible reasons).

|

"The rich have frequently chosen inbreeding as a means to keep estates intact and consolidate power"

-- Go Ahead, Kiss Your Cousin Heck, marry her if you want to By Richard Conniff; DISCOVER Vol. 24 No. 8 (August 2003) |

History and economics show that excessive disparities in wealth are bad for everyone-- including the rich themselves-- and so should be avoided where possible

Economists and social scientists might take notice of this apparent natural human instinct to hoard and concentrate wealth and power to often ridiculous extremes. For although some concentration of wealth appears vital to modern capitalism, excesses in such concentrations can also pose real threats to democracy and prosperity in general-- at least according to past historic events like the Great Depression and others. And excessive wealth/income disparities can have significant undesirable impacts on public health as well, such as raising suicide rates among both rich and poor, among other effects.

|

"The lesson of the Depression was that if ordinary workers lacked jobs and adequate incomes, the economy would crash because too few people could afford to buy what businesses hoped to sell. This was demand-side economics and it laid heavy stress on spreading incomes and job opportunities broadly."

-- Do Jobs Not Matter Anymore? By E. J. Dionne Jr.; August 29, 2003; Page A23; The Washington Post Either excessive wealth or poverty can lead to a greater tendency towards mental illness related suicide...but the wealthy person is a bit more likely to commit suicide than the poor one, under these conditions. So it would appear an increased redistribution of wealth from rich to poor would actually help reduce suicide rates among both groups. -- Wealth Tied to Suicide Risk in the Mentally Ill; Reuters Health/Yahoo! Health Headlines; February 9 2001; citing British Medical Journal 2001;322:334-335 -- Poor less likely to commit suicide; Agence France-Presse; February 10, 2001; Nando Media/Nando Times; http://www.nandotimes.com -- Greater suicide risk amongst rich people with mental illness; EurekAlert!; 8 FEBRUARY 2001; Contact: Emma Wilkinson; ewilkinson@bmj.com; 44-20-7383-6529; BMJ-British Medical Journal The Republican political party of USAmerica controlled both houses of Congress for the whole decade preceding the Great Depression of the 20th century. They also held the Presidency during these years. They pushed tariffs to an all time high, often looked the other way as big business commited violations of the Sherman Anti-Trust Act and market competition within the USA waned, and made tax cuts which benefited the wealthy. It was after all this that the Great Depression took place, lasting for many years. -- Encyclopedia Americana: Republican Party possibly by George H. Mayer, University of South Florida, Grolier Incorporated Republicans controlled both the Senate and the House in Congress, as well as the Presidency, from 1921 to 1933. After the debacle of the Great Depression, they never again managed to control all three of these positions simultaneously for longer than a year or two at a time, at most (as of mid-2003). -- The World Almanac and Book of Facts 2002, pages 92 and 545; World Almanac Books

US President(s): Warren G. Harding, Republican, 1921-1923; Calvin Coolidge, Republican, 1923-1929; Herbert Hoover, Republican, 1929-1933 -- The Universal Almanac 1996, Andrews & McMeel, pages 70-91, and other sources Senate: Republican majority (68th, 69th, 70th, 71st, 72nd Congresses) -- U.S. Senate Statistics: Majority and Minority Parties and Senate Statistics Vice Presidents House of Representatives: Republican majority, (68th, 69th, 70th, 71st, 72nd Houses) -- Political Divisions of the House of Representatives (1789 to Present), Source: Committee on House Administration. Charlie Rose, Chairman. U.S. Government Printing Office. 1994. History of the United States House of Representatives, 1789-1994 Washington: 1994 Many of the Republicans' actions helped exacerbate existing disparities in wealth and income among the US population, which appears to have been one element helping to spawn the Great Depression (for the deflationary aspect of the depression came from too few people being able to afford the goods available in the marketplace). "...in 1929 the top 0.1% of Americans had a combined income equal to the bottom 42%. That same top 0.1% of Americans in 1929 controlled 34% of all savings, while 80% of Americans had no savings at all..." -- The Cause of the Great Depression; The Great Depression. George Bush vs Einstein on economic policy; found on or about 10-18-03 |

But how does America compare to other countries worldwide in terms of wealth and income distribution?

The good news (for Americans) is that our very poorest ten percent of folks are better off than the average inhabitant of third world nations like Bangladesh or Somalia.

|

"The poorest 10% of Americans are still better off than two-thirds of the world population"

-- Inequality Webguide & Research; found on or about 10-18-03 |

The bad news is that compared to NON-third world countries, the vast majority of Americans aren't doing well at all.

|

"The U.S. ranks below six other countries in annual income per person"